Technology Hardware Storage & Peripherals

Highlighted Attractive Groups

We examine the factor category strength behind Apparel Retail, Life Sciences Tools & Services, and Technology Hardware Storage & Peripherals.

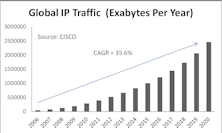

“Old Tech” Profiting From Explosion Of “New Tech” Content?

We identify the “Old Tech” players that will likely reap the benefits from the ever-growing volume of data being generated, stored, and transmitted on line.

Highlighted Attractive Groups

A quick look at the Managed Health Care, Semiconductors, Technology Hardware Storage & Peripherals, and Cable & Satellite groups, all of which caught our eyes this month.

Highlighted Attractive Groups

A quick look at the Commodity Chemicals, Automotive Retail, Aerospace & Defense, and Computer & Office Hardware groups, all of which caught our eyes this month.

Long Only Portfolios Down For The Month But Beat Benchmarks

Select Industries had no group deactivations, trimmed Consumer Finance and purchased Systems Software, further boosting our Tech holdings. Global Industries had no group deactivations, trimmed our Reinsurance and boosted exposure to Health Care, Industrials, and Info Tech groups.

Long Only Portfolios Finish 2013 Strong

Select Industries deactivated Specialized Finance. Global Industries deactivated Food & Staples Retail and Road & Rail and purchased Managed Health Care.

Select Industries: Minimal Turnover

There was little turnover in the GS Scores this month and no group deactivations. With minimal capital to work with, we added selectively to existing group holdings.

Computer Storage & Peripherials - Good Technicals And Industry Outlook

Group Selection (GS) Score has been steadily improving; with big push from Technicals driving group to “Attractive” for the first time since early 2006.

New Group Position: Computer & Office Hardware

The Computer & Office Hardware group had been rated Neutral as recently as December, but quickly moved up the GS Score rankings and received the second highest score in the latest calculations.

That Time Of Year For Tech??

We have found that technology has the strongest seasonal tendency of any sector during the market’s “bullish” seasonal period of November through April.

Adding Tech Back To Select Industries

New portfolio group position being established in Computer Storage & Peripherals, giving us our first tech holding in eight months.

Tech Watch

The broad Tech sector has rallied significantly from lows and is not cheap by traditional valuation measures. Upside driver is earnings momentum, which continues to be strong.

Tech Watch

Still extremely risky area of equities, but recovery may be near. Currently rank six tech groups “Attractive”.

New Select Industries Group Holding: Buying Office Electronics

Upgrade to Attractive is result of broad quantitative improvement in almost all measures.