Thematic

Newfound Popularity Of Thematic ETFs

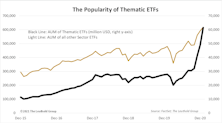

We’ve noticed a small segment of equity ETFs, designated as “thematic,” that is increasingly gaining popularity. Thematic ETFs invest in baskets of stocks that share narrowly-defined business enterprises outside of the standardized GICS methodology.

Leuthold Thematic Baskets 2.0

After a hiatus of several years, we are re-introducing one of our favorite analytical tools. A thematic basket is a custom-designed set of assets which are exposed to, and will react similarly to, a common theme. Our first new thematic basket is “Capital Spending Beneficiaries.”

Capital Spending Beneficiaries

Several key drivers of capital expenditures look particularly favorable right now, and this research note focuses on the potential for improving business conditions to produce an upswing in capex.

The Metamorphosis

Many have now come to recognize the monumental cash flow metamorphosis taking place with many utilities. For well over a decade the utility industry had been chronically short of capital, a condition requiring massive new debt financing and equity financing (often well under existing book values). Today many utilities have become impressive net cash generators, throwing off cash far in excess of projected capital investment requirements.

Time To Look At Shelter Stocks?

Several months ago Pulte Homes was added to our model as a "special situation" anticipating the possibility of a future broader move into the shelter area.

Gilt Edged Growth Time? We Think So

For several months now this publication has been waffling on this question.

Update: South African Hit List Index

This is an index developed in the summer of 1985 made up of U.S. stocks potentially most subject to South African divestiture selling pressure. It includes companies given bad Sullivan ratings and those who have not become signatories. A.D. Little released new Sullivan ratings Nov. 1 and there have been a number of changes.

October 1985 Screens

Jim Floyd has just completed a quarterly update on five stock selection screens. Some clients find this to be the most valuable work in our publications.

An Index of Primary South African Divestiture Candidates

New Jersey’s recent legislation requiring state pension fund divestiture of South African connected stocks may be a landmark. We have compiled a list of 73 stocks that may well be the primary targets for additional divestiture selling by other funds, our Divestiture Hit List.

Conceptual Screens July 1985

Jim Floyd has just completed a quarterly update on four stock selection screens. Some clients find this to be the most valuable work in our publications. Herein, you will find the new additions and deletions for our Undervalued & Unloved, Consumer High Growth, Growth Bargain Basket and Bank Double Plays.

Conceptual Screens, April 1985

Jim Floyd has just finished his quarterly update of four of our conceptual screens. Herein we present the stocks that have been added and deleted in “Undervalued & Unloved,” “Growth Bargain Basket,” “Bank Double Plays,” and “Consumer High Growth.” Descriptions and other statistical comparisons are included.

“Let’s Get Competitive”: A Conceptual Investment Theme

Capital spending to improve manufacturing and industrial productivity may be much higher than anticipated over the next three years. Management confidence is growing, and attitudes are changing: “Yes, we can compete with our overseas rivals.” Here are the stocks and industries that should be the major beneficiaries of this projected development.

What’s New with Investment Concepts?

This update on our research presents three areas of potential interest and also explains why we don’t put much (if any) stock in the fast, coming into vogue “demographic plays.”