Top

A Sign It Could Get “Even Sillier”

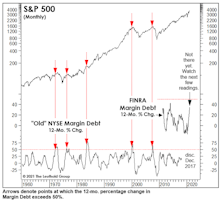

The January moves in heavily shorted Micro Caps were more bizarre than anything we saw during the wildest days of the Tech bubble. Despite these signs of rampant stock speculation by the retail crowd, we still wouldn’t characterize today’s sentiment backdrop as frenzied as the peak levels of 1999-2000.

It Still Doesn’t Look Like A Top

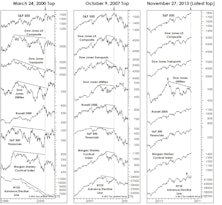

While there are certainly some performance disparities within the U.S. stock market, there’s no way we can argue (even if we’d like to) that it has become too selective.

A Quick Technical Take

If a bear market is imminent, it will unfold with less “internal” forewarning than any cyclical decline since the late 1930s.

So Much For “Red October”

Now that the election is over and QE2 in the works, resist the temptation to “sell the news.” We expect to see the market rally through the end of the year. Sentiment still benign and valuations still attractive.