Trailing EPS

Earnings: Reversing The “New Normal?”

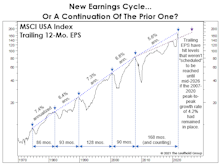

If earnings’ nearly vertical ascent continues for another six months, 12-month trailing EPS will intersect the 6.9% long-term-growth trend line connecting the five major EPS peaks between 1974 and 2007. The “New Normal” has given way to the “Good Ol’ Days!”

Hello To The Roaring Thirties?!

The ink hadn’t dried on 2020’s PPP checks when pundits began speculating that the new decade could be a repeat of last century’s “Roaring Twenties.” That’s become a popular view after a booming 5.7% real GDP growth and a nearly 30% stock market gain in 2021. Just how popular? Analysts are already extrapolating their bullish views into the 2030s!

Party Like It’s 2029?

Trailing EPS that the Street now expects for the twelve months ending November 2022 would not have been achieved until November 2029 if the pre-COVID trend-line EPS growth rate had remained intact throughout the current decade.

The Thirteen-Year Earnings Upcycle

The NBER informs us that the economic expansion is only in its sixth quarter. That’s good to know, but we don’t think investors should be positioned nearly as aggressively as such a statistically-youthful recovery would normally mandate.

Taking Earnings At Face Value

We’ve said before that one of Wall Street’s great inventions is the “forward operating earnings” estimate for the S&P 500, because it results in a P/E ratio that invariably sounds reasonable (if not outright cheap). But this already-misleading EPS metric has become even more so in recent years because of the proliferation of non-GAAP “adjusted EPS” reporting practices.