Treasurys

Bust To Boom, And Back Again

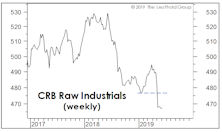

Last month, we observed that crude oil was the only item propping up broad-based commodity indexes, and that something was bound to give with the U.S. dollar pushing to new highs.

Take A Closer Look At “Goldilocks”

We’ve frequently written of the uncanny parallels between the rallies of 2018-19 and 1998-99, but hope that newer readers don’t mistake this analysis as a forecast.

What Are Bonds Telling Us?

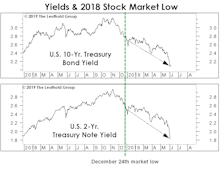

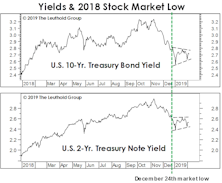

Corporate bonds aren’t the only asset reluctant to embrace the stock market’s latest “all clear” verdict on the 2019 economy.

Credit Conundrum

The stock market seems to have concluded that a recession will be averted in 2019, but evidence from other asset markets is less convincing.

Bonds: No Pain, Yet No Gain

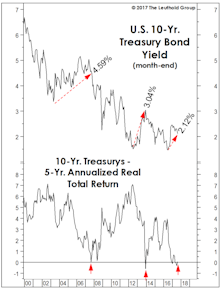

We find it remarkable that the five-year trailing real return on Treasurys has dropped to zero without investors having (yet) suffered any real pain.

Stocks Versus Bonds: A Lonnngggg-Term View

On a 50-year view, stocks do indeed look cheap relative to bonds. But the inclusion of 90 earlier years of data muddies the message.