Underperformance

A Small-Cap Conundrum

Data included in the accompanying tables are normally placed in the Green Book’s Appendix, but we added them here to make an important point: Deteriorating market breadth and Small-Cap underperformance are not necessarily the same thing.

Small Caps Getting Cheaper By The Day

It was September 2020 when we suggested that a new multi-year phase of Small-Cap-stock leadership had begun. Almost immediately, the Russell 2000 reversed a big chunk of the prior decade’s underperformance. Unfortunately, that was the extent of the run.

After The SPAC: De-SPAC Performance

The ultimate measure of a SPAC sponsor’s success is stock performance post merger: De-SPAC results. We analyze historical returns of De-SPACs that had initial market caps greater than $200 million.

The Active Goose, The Passive Gander

Raise your hand if you’ve heard this one before:

(A) 80% of active funds underperformed their index over the past 10 years.

Now, keep your hand up if you have also heard this:

(C) Therefore, investors should buy passive index funds.

Is Passive Ownership Exacerbating The Sell-Off?

With the enormous popularity of ETFs, we’ve wondered if the high level of passive fund ownership could lead to stock price deviation from company fundamentals, and thus create greater price volatility.

The Downside Leaders Look Familiar

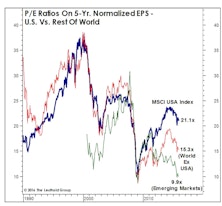

It wouldn’t be a December Green Book without at least one page of hand-wringing over the year’s extreme underperformance of foreign stocks.

Foreign Stocks: The Value Trap Persists

Foreign stocks’ perpetual underperformance has opened up a valuation gap that should look extremely appealing to anyone with a horizon of more than two years. But proceed with caution.

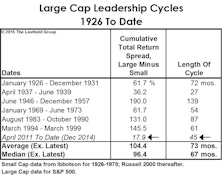

Small Caps: A New Ratio!

Small Caps lagged the S&P 500 by almost ten percentage points in 2014, but their underperformance streak technically dates back to April 2011. Nonetheless, their cumulative, 45-month underperformance in relation to the S&P 500 (now about –18%) is still modest enough that any mention of the current “Large Cap Leadership Cycle” is bound to draw a few head scratches.

Stock Market Leadership In 2014: Large Caps, Tech, Health Care

Following a great year for trend-following, capitalizing on key reversals in sector performance will be important in winning the 2014 performance derby.

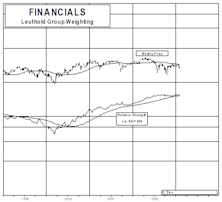

Financials…..Be Careful!

We think it is inadvisable to make a positive sector bet.

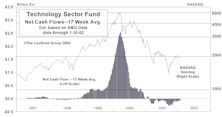

View From The North Country

DALBAR study shows average investor missed out on 17-year bull market performance of 1984-2000.

Bonds: Guaranteed Long Term Underperformance???

Time for an attitude adjustment? We have seen some fat returns on long fixed income securities since rates peaked in 1981. What can we expect from bonds in the future? To help answer this question we look at three sample bonds using a 5 and 10 year risk/reward framework.

The Current Environment

Today the unexpectedly bad unemployment numbers were released. The Fed immediately announced an almost panicky half point cut in the discount rate. The economic recovery may not be for real.