Valuation Ratios

Another Chance To “Buy High”

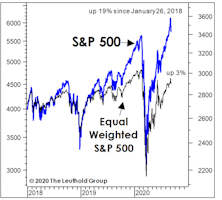

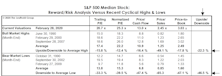

Despite this year’s massive underperformance by the Equal Weighted S&P 500, the median stock doesn’t appear substantially more attractive than the cap-weighted index. Three of five valuation measures are now back in the top decile of readings, which we’d consider pricey in any monetary or economic backdrop.

Valuations: Living Beyond One’s Means?

We won’t dispute that investors were not genuinely frightened at the June market lows, or that fears have evaporated following a 13% rally in the S&P 500. The distress is understandable: For 26 traumatizing days in 2022, our S&P 500 Normalized P/E multiple traded below its 1957-to-date top decile!

The Valuation Case For “SMIDs”

Mid and Small Cap stocks underperformed in 2018 and 2019. However, after the collapse of February and March, these “SMID” Caps have largely kept pace with the torrid rebound in the blue chips. Today’s valuations are priming the SMIDs for a similar “decoupling” in the years ahead, like that following Y2K.

A Fast Start Comes At A Big Price

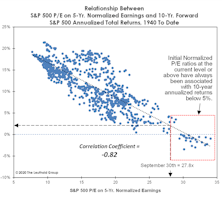

The first up-leg of the bull market has catapulted many Large Cap valuations to levels seen only in 1999, 2000, 2019, and pre-pandemic 2020. At the six-month point on September 23rd, the S&P 500 P/E on 5-Yr. Normalized EPS had already reached 26.9x—a reading that is 30% higher than at the same point of any other bull market.

Back To The Brink

Despite equal-weighted measures’ long-time underperformance, all valuation ratios we monitor for the median S&P 500 stock have returned to their top historical deciles. Even worse, our new equally-weighted “Valuation Composite,” based on these measures, closed August at a 98th percentile reading.

Valuation “Reset?”

The massive performance dispersion of the past two years makes it difficult (if not hazardous) to draw a simple conclusion about U.S. stock market valuations. But it’s safe to say that cap-weighted indexes like the S&P 500 and S&P Industrial Index remained significantly overvalued at the low point of the February correction.

Risks Still High In The “Median” Large Cap

The relative domination of Mega Caps might leave the impression that valuation of the “typical” (or median) Large Cap stock is reasonable. It’s not. The fall rally leaves all major valuation ratios for the median S&P 500 stock in the top decile of the 30-year history, and above the levels prevailing at the September 2018 market high.

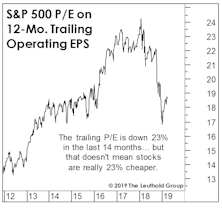

The P/E Decline Has Been Greatly Exaggerated

The S&P 500 has bounced back to levels seen at the January 2018 spike high, yet is valued more cheaply than it was 14 months ago.

Correction Creating Values?

While the consensus view remains that October’s stock market rout was “healthy” and “overdue,” we think it was more likely the first leg down of much larger decline. But it’s still worth reviewing the improvement in valuations that market losses and this year’s excellent fundamentals have combined to produce.

P/E Crash!!

While this year’s liquidity squeeze has yet to exact the toll we ultimately expect on the U.S. stock mar-ket, it has certainly contributed to a sharp compression in P/E multiples.

An Obligatory Rant Over High Valuations

We remain cyclically bullish, but it would be intellectually dishonest to try to make a serious valuation case for the stock market here.

Valuations: The Bad And The Good

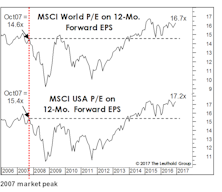

Foreign valuations experienced nowhere near the expansion enjoyed by U.S. stocks during the latest bull market, but their cheaper valuations rarely seem to inoculate them from outsized losses during corrections and bear markets.

.jpg?fit=fillmax&w=222&bg=FFFFFF)