Bear Markets

Bulls, Bears, And Boxing

Bears normally walk on all fours, just like their congenitally happier counterparts. But images we see of bears attacking prey (or humans) usually show them on two feet. Maybe there’s a lesson there.

Valuations: What Bear Market?

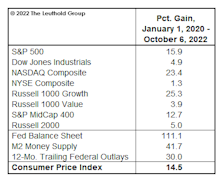

If the October S&P 500 low holds, the normalized P/E ratio of 22.7x on that date will signify the priciest bear market bottom in history; in fact, it is exactly the same level reached as at the August-1987 bull market high. Since October, the normalized P/E multiple has grown to 25.5x—higher than all but three previous bull market peaks.

Roaring Good Times...

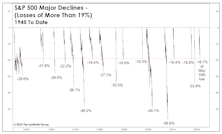

Boy, were the pundits ever right about the Roaring Twenties. Less than three years into the decade, the animal they fear most has already roared two times. Actually, the first one, in the first quarter of 2020, was more like a piercing “yap,” taking the S&P 500 down almost 34% in just 23 trading days. The second roar has been a deeper, more guttural one that’s lasted nine months and is probably not done.

A Market That Defies Description

We’re sure that it’s not lost on our readers, but the stock market loves to toy with people. The dollar costs of a decline and the opportunity lost from misplayed manias are bad enough. This particular market, though, seems to take offense when you merely try to label it. Correction or bear? The debate rages on, even though the flagship fund of the lone equity manager who’s a household name is down 75% from its peak—and still raking in money!

Can Mo Outrun A Bear?

Hiker #1: Can you run faster than that hungry bear looking at us?

Hiker #2: I don’t need to run faster than the bear, I just need to run faster than you.

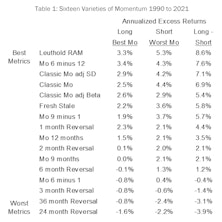

The Momentum style of investing has a long history of generating excess returns, and ranks near the top of the list of essential smart beta factors. However, Momentum also has a dark side; it is prone to severe drawdowns whenever the market makes a significant reversal.