Treasuries

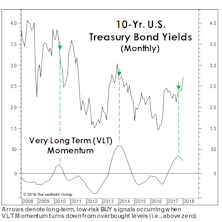

Treasuries’ Short Squeeze—More Room To Run

The massive short squeeze in Treasuries had a perfect setup and a powerful catalyst.

George Bailey Goes To Silicon Valley

One of the most vivid memories of the Great Depression is the sight of nervous depositors lined up outside a bank hoping to withdraw their meager savings before the bank failed. Like a rare tropical disease that was thought to be eradicated by modern medicine, the classic bank run reappeared this month in the form of Silicon Valley Bank. At the beginning of March, the market had no particular concerns about the potential for systemic bank failures, but SVB’s sudden demise has cast a pall over the entire industry.

Minding The Middle

As equity investors, we’ll readily admit to an excessive focus on the Federal Funds rate and the 10-year U.S. Treasury yield.

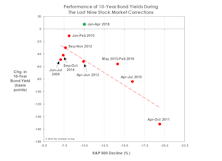

A “Drug-Free” Market Decline?

Yields on 10-year Treasuries are up 10 bps since stocks peaked in January, a clear break from the behavior of prior corrections. The last four stock declines of 10%+ were self-medicating—having been accompanied by bond yield declines of 50 to 150 basis points.

What Yield “Kills” The Secular Bond Bull?

Bond market strategists remain hell bent on identifying the key yield level on 10-year Treasuries at which one can finally declare an end to the 1981-20XX secular bond bull market.

Goldilocks—Enjoy It While It Lasts

The best interpretation of the current cross-asset message is the scenario of goldilocks, and there are reasons to believe this is a possible scenario for the near term.

Current State Of Stock-Bond Relationship = “Easing”

We define four states of the stock-bond relationship based on the directions of stock price and bond yield movements; stocks fear tightening more than true risks, while bonds are more responsive to Risk-On and Risk-Off.

Long U.S. Treasuries: Big Move In May, Downside Still Significant

20 Year T-Bond: 5 3/8’s, Maturity: 2/15/2031, YTM 2.88% (vs. April 30th YTM at 2.39%)

Bond Sentiment Remains Depressed…..Short-Term Rally Could Continue

Inflation pressures have not yet abated and we believe that bond yields could tick up later this year, as those pressures eventually flow through to the CPI.

2007 Outlook: CPI Tame First Half With Moderate Economic Growth

We believe interest rates are headed higher in 2007. Economy picked up some in Q4. Bond market sentiment still looks too optimistic.

Bond Market Remains Overextended...Correction Ahead?

Bond market remains ahead of itself and is vulnerable to correction.

Bond Market Overextended...Correction Ahead?

Bond market seems to be anticipating three key developments: Fed’s stance could switch from tightening to easing, the economy is slowing significantly, and inflation is licked.

Economic Outlook

Continue to project higher interest rates over the next six months, particularly longer maturities. Short rates could begin to decline by early-mid 2007, after Fed finishes tightening and economy slows.

Economic Outlook

It may be difficult for the economy to prolong its expansion, with the auto and housing sectors weakening, and consumer spending a big question mark.

Economic Outlook

Continue to project higher interest rates over the next six months, particularly longer maturities. Further Fed action will be more “data driven”.

Economic Outlook

Continue to project higher interest rates over the next six months, particularly longer maturities. After rate hike in May, Fed’s actions will be more “data driven”.

Economic Outlook

Based on our 6-12 month yield targets, short end of the yield curve looking more attractive.

Has The Yield Curve Lost Its Luster?

The traditional definition versus the new definition of an inversion...How real GDP has responded historically to past yield curve inversions….Effect of inversions on Financial stocks.

Economic Outlook

It may be difficult for the economy to prolong its expansion, with the auto and housing sectors weakening and consumer spending a big question mark.

What Does An Inverted Yield Curve Imply For The Financials?

Conventional wisdom states that inverted yield curves are bad for Financial groups. Doug Ramsey looks at the history of past inversions.

Economic Outlook

It may be difficult for the economy to prolong its expansion, with the auto and housing sectors weakening and consumer spending being a big question mark.

Economic Outlook

The current economic expansion is considered late stage.

Economic Outlook

Still view long rates as potentially vulnerable to strong economy and unexpected inflation.

Economic Outlook

Still bearish on the bond market based on rising inflation and further Fed tightening.

Economic Outlook

Still bearish on the bond market. Boosting bond market target yields based on rising inflation and further Fed tightening.

Economic Outlook

Still bearish on the bond market. CPI inflation could continue to surprise on the upside; the economy never did hit a soft patch; and Fed may still make several more rate hikes.

Economic Outlook

Still bearish on the bond market. From today’s low interest rate levels, there is not much upside, but downside is significant!

Economic Outlook

Still bearish on the bond market. May deficit report encouraging.

Economic Outlook

The current economic expansion will reach four years on 9/30/2005. Since WWII, the average expansion has lasted 57 months.

Economic Outlook

Today, the yield curve has flattened but has not yet inverted. The economy may be in for a soft patch, but there are no signs of recession yet.

Economic Outlook

The U.S. deficit was not a bond market negative in 2004, but continuing long term deficits will become a negative.

Economic Outlook

The current economic expansion reached three years at the end of 2004. Since WWII, the average expansion has lasted 57 months.

Economic Outlook

The current economic expansion reached three years at the end of 2004. Recession could possibly be getting underway by end of 2005.

Economic Outlook

Lower than expected 2004 budget deficit was a short term bond market positive, but longer term deficits are a negative.

Economic Outlook

Deficit narrowing. Last three months’ (including first month of fiscal 2005) receipts remarkably strong, while outlays have declined.

Economic Outlook

Everyday consumers must find it difficult to believe twelve month inflation is just 2.5% (CPI-U), especially when filling up their gas tanks and their grocery carts.

Economic Outlook

Bond yields have declined 40-55 basis points in the past three months.

Economic Outlook

Falling interest rates and declining oil prices should bolster consumer spending and hopefully get us past the current economic soft spot.

Economic Outlook

GDP growth of 4.0% projected for 2004. Improved 2004 budget deficit projections a short term positive for bonds but eventually could be a negative.

Economic Outlook

GDP growth of 5.0% projected for 2004. But, fast growing U.S. budget deficit ($458 billion in 2004?) is a significant problem for bonds.