Bond Funds

2013’s Fund Flow Trends Have Room To Run

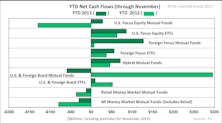

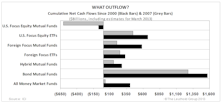

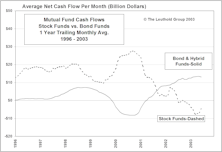

Year-to-date, equity funds are cash on par with those of the 2000 tech bubble, while bond mutual funds are experiencing net cash outflows for the first time in a decade.

Fund Flows Still Not Quite As They Appear

In this report we take an in-depth look at the evolution of the industry, particularly the U.S. mutual fund industry, to help understand how some fund flow trends are more of an indication of evolving investor preferences instead of an indication of retail investor sentiment toward a particular asset class.

An Open (Yet Purely Theoretical) Letter To Individual Investors

When you are all doing the same thing at the same time, it’s usually a good time to question if the investment makes sense anymore.

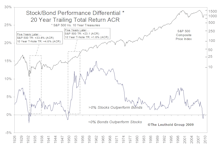

Lemmings Atop The Fixed Income Cliff....And How This Could Play Out Well For Equities

Get out in front of the lemmings. We expect to ultimately see bond funds reverse now that performance has been lagging the stock market. But where will the money go? Our best guess is that it flows to Emerging Country Equities….once again chasing strong performance.

Six Important Trends From The Supply/Demand Front

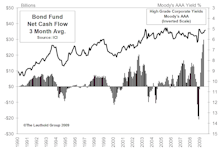

This month’s “Of Special Interest” section looks at six trends from the Supply/Demand front. Key to several of these trends is that investors chase performance: still seeing big inflows into bond funds, with big outflows from retail money market funds.

The Blind Stampede Into Bond Funds

Investor preference toward bond funds, chasing performance, may be left behind once again. Bonds not expected to generate very good returns from current levels based on historical analysis of returns.

January Mutual Fund Flows

Net inflows into U.S. focus equity funds were somewhat ahead of last year’s pace by the end of January. Estimated net inflows of $18 billion compares to last January’s $16.1 billion.

January Mutual Fund Flows

Net inflows into equity funds lagged somewhat behind last January. We estimate U.S. focus equity funds experienced still strong net inflows of $17 billion, but foreign focus net inflows may have been less than $1 billion (net redemptions in the first few weeks).

Where Will The January-February Liquidity Flood Go?

Regardless of conflicting trends being reported in December by AMG and Trim Tabs, our studies conclude that December net inflows into U.S. focus funds (not foreign funds) exceeded December 1996.