Macro Monitor

Trump’s Second First Year—Same Showmanship, Different Stage

The commencement of Trump’s two terms were separated by eight years, a global pandemic, trillions in stimulus, and the quiet burial of several macroeconomic and civic assumptions once thought indestructible. While the personalities and rhetoric remain familiar, the economic backdrop, policy constraints, and market sensitivities of 2025 bore little resemblance to those of 2017.

Risk Aversion Index: A New “Lower-Risk” Signal

Seasonality and the powerful alignment of fiscal support and monetary easing should provide a favorable backdrop.

Top Charts Of 2025 & Persistent Themes For 2026

2025 was a year where “abnormal” became the new normal. From fiscal dominance and stubborn inflation risks to renewed credit stress and a shifting global leadership map, our favorite charts from the past year reveal the forces likely to shape markets in 2026—and where the next opportunities and risks may lie.

2026 Time Cycles—Mostly Favorable

Major market indexes show largely favorable patterns for 2026, but complacency is the real risk after a rare “three-peat” in S&P 500 annual performance.

Risk Aversion Index: A New “Higher-Risk” Signal

Given the convergency of three key risks related to AI, Bitcoin, and private credit, caution is certainly warranted.

The Decades They Are A-Changin’

More than halfway through the decade, a lot of things have changed. We revisit several decade-defining charts from the 2010s and consider where these long-running trends stand today.

Risk Aversion Index: Stayed On “Lower-Risk” Signal

The favorable seasonal window is upon us and the Fed liquidity condition is poised to turn more positive.

Another Loan Bites The Dust—Macro Implications Of Bank Stocks

There is consistent evidence that bank stocks behave like macro proxies. Both domestically and in other major economies across the globe, there is a strong and steady link between lending conditions and subsequent economic activity.

Risk Aversion Index: Stayed On “Lower-Risk” Signal

Monetary and fiscal policies continue to be supportive of risky assets—and the favorable seasonal window is upon us.

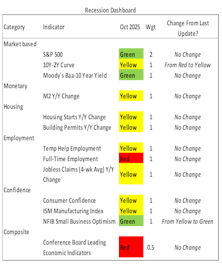

Recession Dashboard Update—Low Recession Risk

The stock rally and associated wealth effect make an imminent recession less likely (data that corroborates our Up/Down Earnings figures). Yet, things can change quickly when so much is riding on the market. Employment is still the biggest threat.

Risk Aversion Index: Stayed On “Lower-Risk” Signal

With a supportive backdrop of a more accommodative Fed and expansive fiscal stance, markets have grown accustomed to spinning both good and bad news into a positive narrative. Within fixed income, we remain constructive toward higher-quality credit.

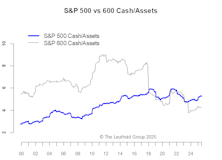

Not All Cash Is Equal—A Tale Of Two Sizes

An examination of how large- and small-cap companies allocate cash across three main uses: investment (Capex and R&D), shareholder returns (dividends and buybacks), and M&A. We further evaluate how, over time, the market rewards or penalizes each.

Risk Aversion Index: Stayed On “Lower-Risk” Signal

Inflation and bond yields, alike, remain well behaved, which is a positive for risky assets. Among fixed income, we are still constructive toward higher-quality credit.

U.S. Dollar—Buy The Dip

The U.S. dollar has seen some interesting dynamics this year, so we’ve updated our U.S. Dollar Monitor. Currently, the model implies a higher likelihood of dollar strength, or at least a decent rebound over the next few months.

FAQ On Stablecoins

Stablecoins are reshaping the financial landscape by combining the stability of the U.S. dollar with the speed and global reach of crypto technology. Backed by short-term Treasuries and used across DeFi, payments, and remittances, they’re becoming digital cash for the internet era. With new U.S. legislation unlocking growth, their impact on banking, global dollar dominance, and Treasury demand is just beginning.

Risk Aversion Index: Stayed On “Lower-Risk” Signal

With the general backdrop of an easing Fed and expansive fiscal stance, the economy should be doing okay.

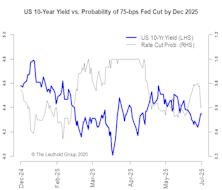

The Fed Pause Playbook—2025 In Historical Context

Economic resilience that prompted the Fed’s pause is consistent with past cases. Equities and bonds have largely followed historical patterns. The exceptions—gold’s outsized return and the dollar’s weakness—highlight the unique risks introduced by the current political environment.

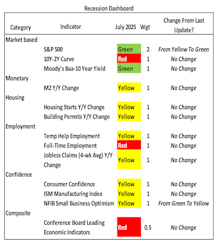

Recession Dashboard Update—Lower Recession Risk

On the whole, the probability of an imminent recession has declined since our last update in April and now stands below 50%. Only two signals changed in this update, the most significant being the S&P 500, which improved from yellow to green.

Risk Aversion Index: A New “Lower-Risk” Signal

We turned constructive toward higher-quality credit.

Bank Lending Slowing? Watch Credit Spreads

Despite heightened uncertainty from shifting trade policies, credit markets remain relatively stable—at least for now. While bank lending standards are tightening and loan demand is softening, market-based indicators like credit spreads and bank stock performance suggest credit risk is contained. If that holds, the broader economy may avoid serious damage, even as tariffs rise.