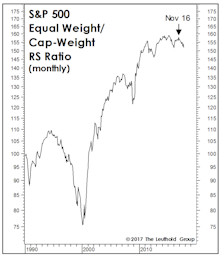

Cap Weight

Cap Weight Or Equal Weight?

The Equal Weighted S&P 500 now trails the S&P 500 by 400 basis points YTD, and the rally is increasingly assailed as too narrow.

Additional Factors

From the lows on February 11th to the end of March, the S&P 500 rallied nearly 14%, propelling the index into positive territory for the YTD. Our Equal Weighed Average sprung back to life in the past two months; the largest handful of firms are no longer driving performance.

Small Cap vs Mid Cap vs Large Cap

Small Cap Premium Drops To 4%

Small Cap/Mid Cap/Large Cap

After residing in the 15-20% neighborhood for the past two years, the Small Cap premium may be finding a new home in the 5-10% range. Weaker earnings growth, and the outperformance of Large Caps over the last 18 months, are pushing the two P/E measurements closer to parity.

Small Cap/Mid Cap/Large Cap

Small Cap Premium Bounces Back To 10%

Answering Client Questions

We always welcome the chance to hear what’s on our readers’ minds, and have often found that seeking answers to these questions can lead to new research topics, interesting charts, and new ways of looking at things.

Big Cap Versus Small Cap: S&P 500 Versus Russell 2000

The following table compares the performance of the Russell 2000 Index (since its inception in 1979) with the S&P S00. Over this entire period, the Russell has outperformed the S&P in ten of the twenty years (S0% of the time), producing a slightly lower annual compound rate, 12.4%, versus 13.6% for the S&P 500.