Confidence Gap

The Inversion Before The Inversion

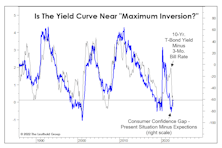

We found the spread between the “Expectations” and “Present Situation” series (the “Confidence Gap”) has historically moved almost in lockstep with the yield curve. As the Confidence Gap plummeted throughout 2021, the implication was the yield curve would soon follow. After some initial resistance, it did.

Too Early For Curve Watching?

Last month, we published a table showing where we thought a variety of economic and financial-market measures lay along the economic recovery “continuum.” Although the upturn has officially entered just its 22nd month, the bulk of those measures looked “late cycle” in nature.

Why Is Confidence “Inverted?”

In a recent “Chart of the Week,” we discussed the late-cycle “inversion” in Consumer Confidence, where consumers’ views of their “Present Situation” have jumped far above their “Expectations.” That’s the reverse of what’s typical in the first couple years of an economic expansion.

Why Is Confidence “Inverted?”

Stimulus and soaring stock prices have contributed to the fastest consumer-confidence rebound of any economic recovery on record. Yet the manner in which this bounce has unfolded is anything but “early cycle.”