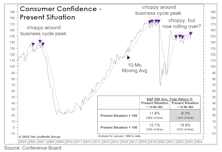

Consumer Confidence

Confidence Cracking?

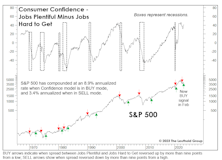

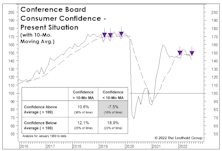

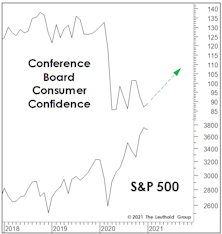

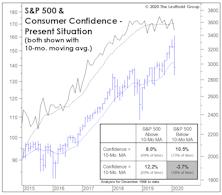

After hovering near the highs of the post-COVID expansion, in August, the Present Situation Index turned down, and is now below its 10-month moving average for the first time since December. When this measure is at a high level, but declining (like now), it is the worst backdrop for stock performance.

The Late-2022 Recession That Wasn’t

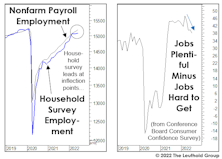

Our Treasury Secretary (and former Fed Chair) has described the JOLT survey (Job Openings and Labor Turnover) as her favorite labor market indicator. We don’t know why: It’s a good survey, but similar figures become available about two months in advance of JOLT.

The Job Market Just Rescinded A Recession Signal

For those disappointed that February’s employment report won’t be released until March 10th, we have something to consider in the meantime.

Confidence & Causality

It will be years before policymakers know the long-term effects of the COVID experiment with Modern Monetary Theory. However, the episode has helped answer, once and for all, a question that’s troubled psychologists forever: Money can buy happiness! But it can’t buy hope.

Confidence Cracking?

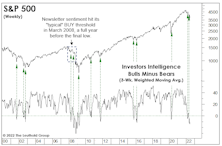

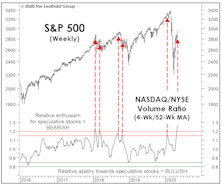

The theory of “contrary opinion” is important to market analysis, but so is an understanding of its limitations. When investor-sentiment surveys dipped sharply in late January, we warned that the declines (which are usually signals to “buy”) might instead mark the beginning of an important trend change.

Job Market Suddenly “Laboring”

We cringe when we hear the Treasury Secretary or a regional Fed bank president dismiss the possibility of recession on the basis of “low unemployment and strong job gains.” Those measures are as “laggy” as any economic statistics the government publishes.

Sentimental Musings

Most sentiment measures show none of the frothiness that lingered in the months after the Y2K Tech bust. Rather, some exhibit actions reminiscent of early 2008.

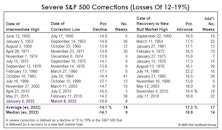

Special Study: Should You Buy The Dip? Some Statistical Considerations…

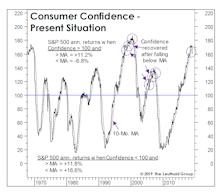

The correction in the S&P 500 since its high on January 3rd qualifies as a “severe” correction, which we define as a decline of at least -12% based on daily closing prices. What are the odds that it becomes a “major” decline*—in which the loss exceeds -19%?

In Section I, we review the history of severe corrections since 1950. In Section II, those corrections are analyzed in the context of the economic cycle, consumer sentiment, and other underlying factors—ones that might help us determine if today’s stock-market weakness is “buyable.”

Too Early For Curve Watching?

Last month, we published a table showing where we thought a variety of economic and financial-market measures lay along the economic recovery “continuum.” Although the upturn has officially entered just its 22nd month, the bulk of those measures looked “late cycle” in nature.

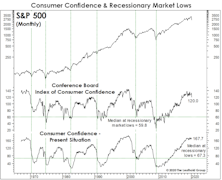

Why Is Confidence “Inverted?”

In a recent “Chart of the Week,” we discussed the late-cycle “inversion” in Consumer Confidence, where consumers’ views of their “Present Situation” have jumped far above their “Expectations.” That’s the reverse of what’s typical in the first couple years of an economic expansion.

Why Is Confidence “Inverted?”

Stimulus and soaring stock prices have contributed to the fastest consumer-confidence rebound of any economic recovery on record. Yet the manner in which this bounce has unfolded is anything but “early cycle.”

How It Bodes For Biden

Early evidence suggests the Biden administration and the newly “purple” Senate will resist the pull of the far-left, at least from an economic perspective. Stock investors are cheering... though in light of their current euphoria, they might as well have celebrated a write-in victory for Ralph Nader alongside Green Party control of the Senate.

Climbing The Wall Of Confidence?

Stock market valuations may be considered the ultimate in fundamental measures, but they can just as easily be considered long-wave sentiment indicators. What causes equity investors to pay as little as 10x for S&P 500 Normalized Earnings at one point (March 2009), but pay more than 30x a dozen years later? The Fed printing press was in overdrive at both points; only emotions can account for the difference.

An Historical Look At Biden’s “Future”

We’ve read far too much about what Joe Biden and a newly-blue Congress might do in the months ahead, but less so about the conditions Biden and his team inherit. Such “initial conditions” usually have a heavy hand in policy outcomes, market outcomes, and even a president’s legacy.

Is “NASDAQ Fever” Peaking?

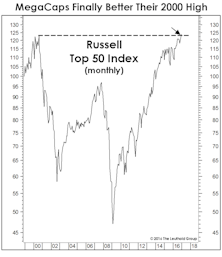

Even casual market observers have begun to marvel at the NASDAQ’s ability to defy the rest of the stock market, and the “U.S. Exceptionalism Index” continues to go parabolic.

A Bear Market In Price, But Not Time

We have a hard time accepting that the excesses associated with an eleven-year bull market and expansion can be fully expunged in 27 trading days, no matter how ugly those days were… keep some powder dry!

Confidence Is The Key

The bull case for a “brief” pandemic-related recession and powerful recovery is the same as the bull case from two months ago for “no recession or bear market” at all: stimulus (as if that’s exactly what the U.S. economy has lacked for the last 11 years).

Sentiment Has Been Crushed, But Might Need To Just Languish For A While

We didn’t see the coronavirus coming and, like millions or perhaps billions of others, underestimated its likely economic impact when it began to spread. But stock market risks were high well before the virus hit.

Back Breaker?

With the wavering state of consumer and business confidence, even a modest stock market correction of 8-10% might deliver the fatal blow to confidence—and therefore to the U.S. economic expansion.

More Trends We Don’t Find Friendly…

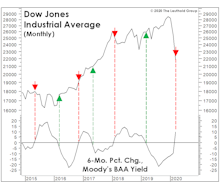

The yield curve’s ten-month moving average inverted in September, hence the yield curve inversion can no longer be dismissed as transitory; the Boom/Bust Indicator remains below its descending 10-month moving average, confirming economic weakness predicted by the yield curve; and, the “Present Situation” component of September’s Consumer Confidence survey slipped below its 10-month moving average for the third time in 2019.

Altitudes And Attitudes

Trend followers who use the ten-month moving average discipline finally had a positive month in July. But after the early-August decline, they are still holding an S&P 500 loss of 60 points from their latest trade initiated at the end of June.

Slowdown Or Recession? Confidence Is Key

The pattern of sharp sell-offs followed by equally sharp rallies continued in June. Most risky assets recouped nearly all the losses suffered in May, and then some.

It’s A Confidence Game

U.S. stock funds have seen heavy outflows despite the market’s YTD gains of 15-20%, once again reviving the tired characterization of this bull market as the “most hated in history.”

A Confidence Game

Several consumer confidence gauges plunged in the wake of the Q4 market decline (as expected), and then rebounded in a lagged response to the stock market recovery (again, as expected). But March saw the largest one-month drop in consumers’ assessment of their “Present Situation” since 2008.

The Cycle Is Over If Confidence Fades Further

The “Expectations” component of the Consumer Confidence survey has been wobbly in the last few months, but the latest report, released on Tuesday, showed the first meaningful hit to consumers’ “Present Situation” since the stock market first began to struggle 14 months ago (Chart 1).

You Call That A Panic?

Christmas Eve came not with snowfall but a market freefall which was the worst-ever recorded for that date.

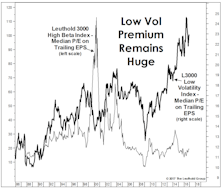

Tilt Toward Beta

Stock market valuations certainly show no lack of investor confidence: each of our “Big Six” valuation measures now resides in either its ninth or tenth historical decile.

Plenty Of Love For The Rally

The less-well-known Stock Market Confidence survey from the Conference Board has poked into “excessively optimistic” territory for the first time since 2003

Safety In Numbers?

The S&P 500 closed the first week of January at a new cycle high, up 9.2% from the pre-election low made on November 4th.

“Changes In Attitudes, Changes In Latitudes”

The above caption—and Jimmy Buffett song title—comes from the “View From The North Country” section in the first-ever Green Book published in November 1981. Not much has changed in 35 years.

Lack Of Confidence Has Been Greatly Exaggerated

While this 7 1/2-year bull market has failed to give rise to anything resembling the equity culture of the late 1990s, we think it’s a stretch to claim—as dozens of commentators over the past five years have—that this bull is “the most hated” in history.

Confidence & Stock Prices

Consumer Confidence shot to new cycle highs in March, closing within 6-7 points of the peak made shortly before the Great Recession.

Confidence & Stock Prices

We’re still bullish, but nonetheless feel a duty to take issue with some of the popular story-lines that have attended the past two years’ rising prices.

Stocks And The Economy

We’ve written before about retail investors’ tendency to “conflate” stock market action with movements in the underlying economy. Misunderstanding this interrelationship generally causes the public to liquidate stocks when the economy is weak, only to ultimately buy them back when the economic recovery is obvious to all.

Risk Aversion Edged Up - Stay Defensive And Be Patient

The Risk Aversion Index edged up during November. It is still on a “higher risk” signal. We will stay defensive and be patient. Higher quality assets within the fixed income space are favored.

Morose On Main Street… So Why Isn’t The Smart Money Worried?

Consumer confidence levels have sunk to five year lows. Could this be a bullish omen for the markets?

Jobs/Consumer Data Flashing Recessionary Signals

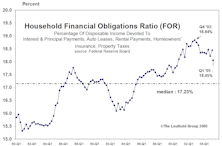

Optimists have continuously cited low unemployment and the ever resilient U.S. consumer as two “pillars of strength” that will help keep the economy afloat. It has become considerably more difficult to make this case in recent months, as jobs and spending data have weakened to levels associated with recessions.

Consumer Watch– Economic Data Weakening, Consumer Stocks Already Discounting A Slowdown

Our view that the consumer is due for a pullback has been bolstered in recent months, as Consumer Discretionary groups have continued to slip in our Group Selection (GS) Score rankings.

The Demise Of The Consumer

“Of Special Interest” section examines the likely demise of consumer spending power. Taking a lead from the GS Scores and other economic data, we believe that a significant underweight in areas that are particularly sensitive to consumer spending is a prudent strategy for now.

The Consumer: Still Chugging Along

Consumer spending may have finally peaked in this cycle, but a consumer collapse is far from imminent. Consumers can be expected to remain supportive of economic growth.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)