Corporate Bonds

Tactical Junk

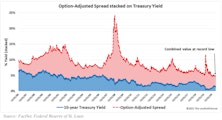

High yield bonds returned a robust 15.4% in the year ending June 30, extending a winning streak that produced a 56.4% cumulative return since the end of 2015. After a quick, severe drawdown at the height of the COVID-19 scare, junk bonds have experienced nearly ideal market conditions, heralding a return to trends that have been in place for several years. The post-pandemic move toward this record low has been a boon to high yield bond investors, but it has also created a significant risk of reversal. We believe most things in the financial markets are defined by cycles, with Treasury yields and credit spreads no exception. Tight readings for both rate series demand that we consider the possibility that a cyclical reversal could weigh on junk bond prices going forward.

Research Preview: High Yield’s Heyday

High yield corporate bonds returned over +15% for the twelve months ended June 30th, building on a strong five-year run that was interrupted by a short, but painful, drop at the onset of COVID-19. Chart 1 indicates that high yield bonds compound at a remarkably steady rate, with infrequent but severe drawdowns during times of financial stress.

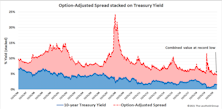

BAA Acting Baaaadly!

Whether or not they’ve risen for the “right” reasons remains up for debate, but the upward move in interest rates has hit the usual suspects very hard in 2018, like early-cycle industries and Emerging Markets.

U.S. Investment Grade Corporate Bonds: Maintain Favorable

More spread compression is likely ahead.

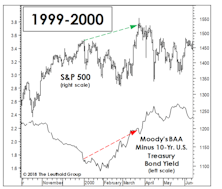

Weakening Foundation

Over the last few months, we’ve presented a couple of simple quantitative studies meant to encapsulate the factors driving our Major Trend Index to the brink of bear territory. The chart and table might provide the best summary yet.

US Bonds

Net outflows continued as the cushion from credit spreads is still inadequate...So far risk contagion from the Puerto Rican bond default has not been an issue. Munis still look attractive relative to Treasuries, and investment grade Corporates...The improvement in credit markets and inflation expectations looks more shaky as oil prices broke below the recent tight range and uncertainty around Greece adds to the overall risk aversion. We reduced these bonds to Unfavorable.

U.S. Bonds

U.S. Quality Corporate Bonds & Munis Rated Favorable; High Yield Bonds Rated Neutral.

U.S. Bonds

Given the higher volatility and increased risk aversion, high grade credits are attractive as the negative relationship between rates and credit spreads dampens the volatility of this asset class.

U.S. Bonds

The thin liquidity likely magnified the move in both rates and credit spreads, but we continue seeing a friendly macro environment that supports high quality credits.

US Bond Grades

The renewed participation of credits in the risk asset rally is a welcome sign.

Our Position on U.S. Bonds

U.S. Investment Grade Corporate Bonds: Favorable, U.S. High Yield Corporate Bonds: Neutral, U.S. Municipal Bonds: Neutral

U.S. Investment Grade Corporate Bonds: Maintain Favorable

This is consistent with our overall cautious view on credits. Credit spreads continued narrowing despite higher volatility in the bond markets.

U.S. Investment Grade Corporate Bonds: Maintain Favorable

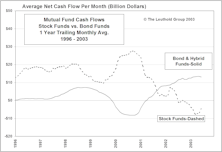

Despite the exodus from all bond classes in the last few months, longer term demand for safe spreads is likely to remain strong and investment grade issuance has dropped significantly.

U.S. Investment Grade Corporate Bonds: Maintain Favorable

The longer term demand for safe spreads is likely to remain strong once yields normalize and volatility recedes.

U.S. High Yield Corporate Bonds: Maintain Neutral

High yield bonds are not immune to the tapering of QE.

U.S. Investment Grade Corporate Bonds: Maintain Favorable

Consistent with our overall cautious view on credits, we still like “safe spreads”.

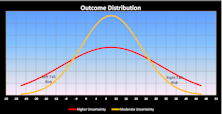

Looking Deeper Into The Tails Of Distribution

Leuthold’s Eric Weigel examines both positive and negative tail risk among asset classes over two time periods… the recent volatile era versus a preceding, not-as-volatile time period.

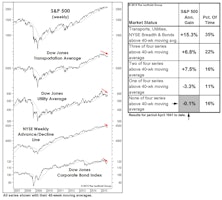

Despite January, Big Picture Still Bullish

Don’t think we’ve seen a cyclical top, because that would mean everything essentially topped at the same time. Breadth has yet to peak in this cycle and that is one reason we expect the market to move higher over the near term.

2007 Outlook: CPI Tame First Half And Economy Chugging Ahead Slowly

Expect economic recovery to pick up a little steam in early 2007, before slowing down in the second half. A 2008 recession is a possibility.

Economic Outlook

Based on our 6-12 month yield targets, short end of the yield curve looking more attractive.

Has The Yield Curve Lost Its Luster?

The traditional definition versus the new definition of an inversion...How real GDP has responded historically to past yield curve inversions….Effect of inversions on Financial stocks.

The Blind Stampede Into Bond Funds

Investor preference toward bond funds, chasing performance, may be left behind once again. Bonds not expected to generate very good returns from current levels based on historical analysis of returns.

View from the North Country

Merrill Lynch was first but the rush is on, stripping existing T-Bonds of their coupons, repackaging and selling coupons and principal separately. While perhaps priced too high for sharp pencil pushers, to us they look like a very good investment. Corporate “zeros” should, however, be viewed very cautiously.