Credit Risk

The World Of Emerging Market Bonds

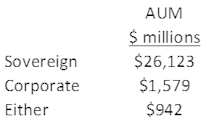

Investors looking to diversify away from the U.S. interest rate environment and/or the domestic business cycle may wish to consider Emerging Market bonds, an asset class with lower correlations to the U.S. Agg. Bond Index. EM bond investors can choose between several investment attributes to find the risk / return profile with which they are most comfortable. This study surveys the investment tradeoffs offered by each sub-category, as defined by ETFs focused on each particular asset class.

Research Preview: Emerging Market Bonds

The U.S. Aggregate Bond Index lost 3.8% in April, bringing its year-to-date return to an agonizing -9.5%. The realization that bonds can lose big money, combined with the outlook for stubbornly high inflation and continued rate increases, is nudging bond investors to consider a wider scope of alternatives.

Small Cap Quality Check

December’s Of Special Interest provided a recap of our Asset Allocation team’s view of small cap equities, suggesting that small caps had underperformed and reached a valuation discount that made them an interesting contrarian value proposition. Several clients responded with follow-up questions, wondering if the discount valuation of small caps was offset by their typically weaker business models.

Risk Aversion Index—Moved Up Again, Stayed On Higher Risk Signal

The hawkish Fed and various geopolitical risks weigh on market sentiment, so caution is highly recommended.

Risk Aversion Index—Ticked Lower, Still On Higher Risk Signal

New ECB stimulus should support risky assets near term but caution is warranted.