Credit Spreads

Tactical Junk

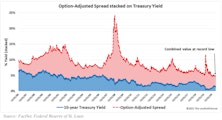

High yield bonds returned a robust 15.4% in the year ending June 30, extending a winning streak that produced a 56.4% cumulative return since the end of 2015. After a quick, severe drawdown at the height of the COVID-19 scare, junk bonds have experienced nearly ideal market conditions, heralding a return to trends that have been in place for several years. The post-pandemic move toward this record low has been a boon to high yield bond investors, but it has also created a significant risk of reversal. We believe most things in the financial markets are defined by cycles, with Treasury yields and credit spreads no exception. Tight readings for both rate series demand that we consider the possibility that a cyclical reversal could weigh on junk bond prices going forward.

Research Preview: High Yield’s Heyday

High yield corporate bonds returned over +15% for the twelve months ended June 30th, building on a strong five-year run that was interrupted by a short, but painful, drop at the onset of COVID-19. Chart 1 indicates that high yield bonds compound at a remarkably steady rate, with infrequent but severe drawdowns during times of financial stress.

Looking To Credit For Clues

One of the first cautionary signals to emerge during the market’s two-year topping process was the failure of spreads on low grade corporate bonds to return to their early-2018 cycle “tights,” despite last year’s surge to new stock market highs.

A Real Corona-Crash In Credit

If the U.S. economy falls into recession in the months ahead, it might be the only one in history that will be remembered as having been triggered by a “black swan.”

Credit Cracking?

One of the key pillars of the bullish case has been the supposedly “benign” trend in corporate credit. While that’s been true for holders of the popular junk bond ETFs (HYG and JNK), the broader credit picture is not as reassuring.

Credit Conundrum

The stock market seems to have concluded that a recession will be averted in 2019, but evidence from other asset markets is less convincing.

Risk Aversion Index: New “Lower Risk” Signal

Our Risk Aversion Index fell sharply last month and triggered a new “Lower Risk” signal. Caution is still strongly recommended, and we favor higher-quality credit within fixed income.

Four Divergences—A Steepening Correction

While we still believe flattening is the more likely scenario over the medium term, we do feel the recent flattening move is a bit overdone and there are several divergences that suggest a short-term steepening correction is in store.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

Despite January, Big Picture Still Bullish

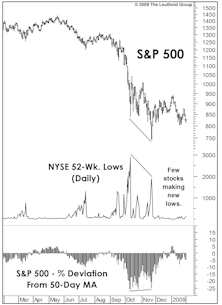

Don’t think we’ve seen a cyclical top, because that would mean everything essentially topped at the same time. Breadth has yet to peak in this cycle and that is one reason we expect the market to move higher over the near term.

Are You Smarter Than A Bond Investor?

During the past several years, it has become fashionable to believe that bond investors are more sophisticated than stock investors. Personally we don’t buy that bond investors have any edge in intelligence or diligence.

"Spreading" The Message

Credit spreads have blown out to levels not seen since the 1930’s. What are the implications for the market?

Positive Technical Trends

While there is plenty to worry about, some important technical trends still suggest that November 20, 2008 stands a good chance of being the final low of this bear market.