Domestic Groups

A Tale Of "The Tail That Wags The Dog"

We believe the continued strength of this seemingly ageless bull market is due in part to the weakening U.S. dollar, which impacts the real economy and financial asset returns alike.

Just A Costly Correction?

If February 11th marks a lasting low for stocks, the 2015-16 decline will go down as one of the costliest in history not to have reached bear market status.

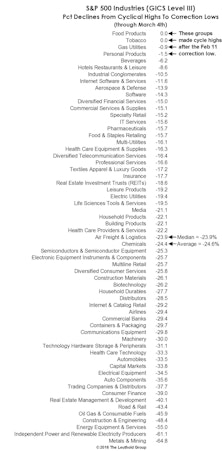

Beware The Deceptive S&P…

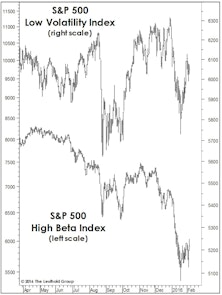

At its January 20th closing low, the S&P 500’s peak-to-trough decline of –12.7% barely met our definition of a severe market correction (an S&P 500 loss of 12% to 18%). But the behavior of this particular index can be quite sinister during the final phase of a bull market—and during much of the ensuing bear.

The Bear Case: "Before And After"

Leadership: Winning Begets Winning

Many assume that stocks and industries exhibiting high price momentum suffer disproportionately during the eventual bear market. Surprisingly, the high momentum stock portfolio has suffered an average bear market loss that’s about a quarter less than that of the low momentum portfolio.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

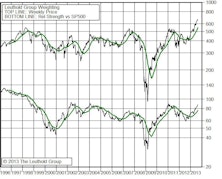

Industry Group Dreams And Nightmares

For more than a quarter century, The Leuthold Group has tracked hypothetical industry group portfolios composed of the previous year’s “Dreams” (best performers) and “Nightmares” (worst performers). The former is a gauge of a simple, trend-following investment strategy, while the latter is a crude form of industry group “bottom-fishing.” Sticking with tradition, the following pages detail how the 2013 Dream and Nightmare portfolios faired in 2014, and we reveal which industries qualify in the Dream and Nightmare portfolios of 2014.

Biotech Off To An Explosive Start

| Best Performing Industry Groups | |||

|---|---|---|---|

| Industry Group | 1 Wk Perf |

4 Wk Perf |

YTD Perf |

| Biotech...Small/Micro | 8.5% | 28.2% | 23.8% |

| Precious Metals | 7.1% | 11.8% | 7.2% |

| Biotechnology | 6.2% | 13.9% | 10.1% |

| Diversified Metals & Mining | 5.9% | 6.2% | 0.0% |

| Computer Storage & Peripherals | |||

Select Attractive Domestic Groups

Auto Parts & Equipment, Systems Software, Life & Health Insurance and Life Sciences Tools & Services are featured this month.

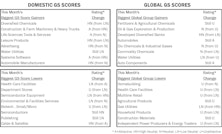

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

Group Models Agree On Energy & Materials

But Information Technology rises to the top of the Domestic model, while the trend of Financials domination in the Global model remains intact.

Domestic and Global Group Models: Strong Agreement On Financials

Our Domestic Scores have five Financials groups rating Attractive; these same five industry groups are Attractive in our Global model. In total, seven Financials groups rank Attractive in the Global model, with insurance groups looking particularly Attractive.

Still Flying With Airlines

While their scores remain strong, the underlying factor strength has shifted as these stocks have soared. Our quantitative disciplines and a compelling underlying fundamental story are keeping us in flight.

Four New Equity Group Purchases—Highlights of Quantitative and Qualitative Strengths

Substantial turnover in Select Industries Portfolio created room for several new industry group positions to be established.

The Top Line Story: Which Groups Are Improving, Which Are Deteriorating

Believe it or not, 21 of our equity groups have not yet seen a quarterly decline in revenues. Several early cycle type groups have already experienced four quarters of declining revenues, but the good news is three groups have posted rebounds in revenues as of Q1 2009.

Stimulus Spending Beneficiaries

Five groups we think are poised to benefit form the stimulus legislation.

New Select Industries Group Position– Auto Parts & Equipment

Auto Parts & Equipment has rated Attractive in seven of ten months this year, including the last two months.

Oil & Gas Drilling– New Group Addition To Select Industries Portfolio

Oil & Gas Drilling is tied for fifth in our Group Selection Scores this month and was purchased for the equity portfolio.

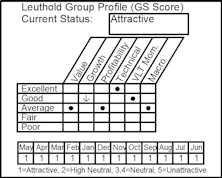

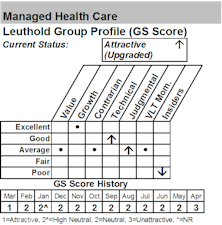

Health Care Groups Show Strong Improvement In March GS Scores– Buying Managed Health Care

The biggest change within the GS Scores this past month has been the strong improvement in Health Care groups. In response to this, we added to our Health Care exposure with a new group position in Managed Health Care.

Why It Has Been Tough To Beat The S&P 500 In 2006

This month’s “Of Special Interest” study presents a handful of factors that explain why life for active managers has been much more difficult in 2006.

GS Score Rankings Continue To Produce High Turnover– Selling Life Sciences, Buying Tobacco

We initiated a new position in the Tobacco group, which is currently exhibiting strength across all categories of the GS Scores

October's Market Action

The stock market’s turbocharged advance continued into October, putting YTD performance for the majority of broad market indexes into the double-digits.

New Select Industries Group Position: Reinsurance

Many stocks had outperformed in October and were retained in the Select Industries Portfolio, but there were enough sales to build new holding in Reinsurance.

Sentiment Still Supportive

Sentiment measures still show pessimism among investors. Doug Ramsey looks at the current sentiment gauges for the market and also examines the current sentiment readings for 24 broad industries groups.

Q3 Market Action

Perhaps if you were living in some obscure quarter of the Amazon jungle for the last month, you may not have heard the news that the Dow Jones Industrials Average was approaching and finally achieved a new all-time high in late-September and early October.

Weathering The Strapped Consumer – Introducing New “Strapped Consumer” Theme

While we currently favor little to no allocation to Consumer stocks, we realize that many clients must maintain a substantial weight in the Consumer Discretionary sector. For those clients, we are proposing a new thematic stock market group this month: The Strapped Consumer.

August Market Action

S&P 500 is now within striking distance of hitting new cyclical highs.

Attractive Groups Based On Insider Scores

We have been taking the opportunity each month to highlight a portion of our groups’ insider buying and selling scores. This month, we are presenting the groups with the best insider scores.

Buying Deep Value Theme in Select Industries Portfolio

Proceeds from the sales of the Rails were used to establish a new 8.1% position in “Deep Value” stocks.

July Market Action

In July, weakness early in the month later transitioned into a comeback rally of sorts for the major stock market indexes.

Unattractive Groups Based On Group Insider Scores

In prior issues, we have presented those equity groups that had been displaying the best readings in terms of insider selling/buying. Several clients have expressed an interest in seeing those groups with the most significant levels of insider selling. The following table presents the ten groups with the most pervasive insider selling.

Q2 Market Action

For the first time since the market low in March 2003, many investors got a chance to remember what a good old fashioned correction felt like.

Attractive Groups Based On Group Insider Scores

During the last few months, we have been looking at the Insider Selling and Buying among various broad sectors and have also recently been presenting those specific equity industry groups that currently have the best scores based on the insider patterns of selling and buying.

May's Market Action

“Sell in May, then go away” goes that old piece of Wall Street wisdom. Problem is, this year everybody seemed to sell in May, so going away doesn’t seem like such a good idea anymore.

Attractive Groups Based On Insider Scores

During the last few months, we have been looking at the Insider Selling and Buying among various broad sectors and last month decided to present those specific equity industry groups that currently have the best scores based on the insider patterns of selling and buying.

April Market Action

The big stories driving the day to day market action in April continued to be (in no particular order) the future of Fed policy, oil prices, the economy, and escalating tensions with Iran. However, despite the various uncertainties and vagaries regarding the aforementioned, many stock market indexes hit cyclical bull market highs during the month.

Defensive Equity Groups...Some Time-Tested Ideas, And A Few New Ones

In our most recent update of our defensive group work, we examined industry group performance within the last four bear market cycles in order to determine which groups delivered consistent leadership.

Attractive Groups Based On Insider Scores

Best looking groups based on current Insider Buying Selling patterns include: Gas Utilities, Aluminum, Brewers and Auto Manufacturers.

First Quarter Market Action

Stocks continued to move higher in the first quarter, with many of the broad market indexes finishing out Q1 near their cyclical highs.