Drug Retail

Brick & Mortar Retail Evades October Sell-Off

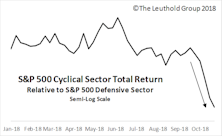

Although Discretionary stocks broadly underperformed during October’s market decline, prominent amongst the very top industry group performers was a rather unexpected genre of industries—brick & mortar retail. Not only did this cohort hold up during October’s tumult, but many of the underlying stocks have been posting strong returns all year.

Highlighted Attractive Groups

Drug Retail, Life Sciences Tools & Services, and Specialized Finance are among the month’s intriguing opportunities based on the current GS Scores.

Drug Retail Gets High

Household Products and Drug Retail are this week's best groups. Oil & Gas Exploration & Production and Airlines were this week's worst groups.

Highlighted Attractive Groups

Airlines has spent only three months below “Attractive” since early 2012 and the group’s factor category scores continue to provide solid results. We also like the growth prospects for Drug Retail and Apparel Retail.

Drug Retail Leads This Week

Drug retail scraped out a respectible 2.5% (through July 9th) on a down market week to up their YTD to 18%.

Bought Drug Retail = Consumer + Health Care In One Dose

A new position in Drug Retail was added to the Select Industries Portfolio in April. The latest update to the Group Selection (GS) Score showed improvement in several factor categories which pushed the overall score back to Attractive.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations again this month, but we trimmed a few groups and added Commodity Chemicals. All group holdings currently rate Attractive. Global Industries had no changes. Emerging Electric Utilities, which we added last month, was the second best performing group in March.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations this month, and we made no significant changes to our group weights. All group holdings currently rate Attractive. Global Industries eliminated our longest tenured group, Regional Banks, which we held for two years. We added Emerging Electric Utilities, which is our first EM oriented group since June 2013.

Long Only Portfolios Finish 2013 Strong

Select Industries deactivated Specialized Finance. Global Industries deactivated Food & Staples Retail and Road & Rail and purchased Managed Health Care.

Select Industries: Minimal Turnover

There was little turnover in the GS Scores this month and no group deactivations. With minimal capital to work with, we added selectively to existing group holdings.

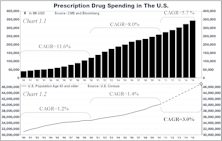

Drug Retail - Ride The Rising Tide Of Prescriptions

Drug Retail and other related groups could be poised to ride the rising tide of prescription drug spending.

Select Industries: New Groups Initiated

In late October, Select Industries Equity Portfolio established three new holdings in Drug Retail, Hypermarkets & Super Centers, and Data Processing & Outsourced Services. Even with the MTI in Positive territory, we are maintaining some defensive exposure, as global economic worries persist.