EAFE

Research Preview: Returns In A Year Of Dollar Strength

The U.S. Dollar Index (DXY) has gained 16.2% YTD, its best performance in almost 40 years. However, a strong dollar is bad for those with international investments, as returns are slashed when translated back into dollars.

Our Annual Lament On Foreign Equities

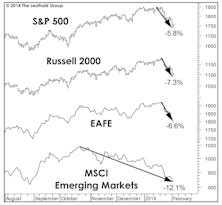

There should be a name for the syndrome suffered by foreign stock investors over the last decade or so. “Groundhog Day” doesn’t quite cut it, because that event repeats only once a year. It seems like this time of year we always feature a chart showing a healthy YTD double-digit gain in the S&P 500, along with a bond-like gain in EAFE, and a bond-like gain or loss in the MSCI Emerging Markets Index.

EAFE And EM: Long Past Their “Peaks?”

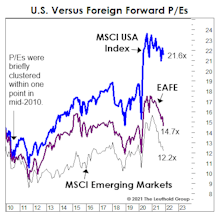

We applied the “Peak Cash Flow” valuation methodology to the EAFE and MSCI Emerging Markets Index and found them both priced at only about one-half of today’s MSCI U.S. multiple. However, the ratios are already above anything achieved during the 2009-2020 global bull market.

Foreign Stocks Party Like It’s The “2010s”

The most likely catalysts for improved relative performance of foreign stocks would be: (1) a bear market; (2) a recession; and, (3) a major downturn in the U.S. dollar. This year has supplied all three, yet the relative strength ratios of most foreign equity composites continue to grind lower as if it’s “business as usual.”

A Storied Bubble’s Pearl Anniversary

The decade of the teens has given way to the decade of the twenties and “year in review” retrospectives are in the books, but as the calendar’s last digit rolls from 9 to 0 we consider one more anniversary worth remembering.

Bottom-Spotting In Foreign Stocks

The tale of two markets has existed for years, but now it’s getting ridiculous.

Sizing Up The Rally

There’s an old saying that bear market rallies look better than the real thing, yet the upswing off December lows looks even better than the typical bear market rally.

Foreign Stocks “De-Coupling”

Market action has been broader and better than we expected given monetary conditions, and Small Cap strength seems to lend credence to contention that rates aren’t yet high enough to bite.

The Foreign Stock Conundrum

A good rule of thumb for thematic and sector investors is that stock market leadership rarely repeats itself in consecutive cycles.

Foreign Stocks: What Will Turn The Tide?

After a brief respite last year, EAFE has reverted to its old form by falling 300 basis points behind the S&P 500 so far in 2018. EAFE’s main transgression might simply be that it represents good relative value in a market that’s been rewarding only momentum...

Foreign Equity Leadership?

Is it too late to tilt a portfolio toward foreign stocks?

America’s Already First...

Thanks to the U.S. dollar’s recent spike, foreign equities in dollar terms declined during November while the U.S. markets were celebrating a Trump victory. Thirty-nine of the 49 MSCI country indexes are in bear market territory from the perspective of a dollar-based investor.

Foreign Stocks Set For A New “Bear”-ing?

Based on comparative valuations alone, one could have made a case for investing in foreign stocks over domestic ones as early as 2010—when EAFE’s valuations sunk to an historical low, relative to the S&P 500. Today, that gap remains extreme.

A Kind Word For “Forward Earnings”

Our criticism of the widespread trust in “forward earnings” has sometimes been harsh, but consider the following: the latest 12-month forward EPS estimate for the EAFE index is $122.71, virtually matching the forward estimate that was made in January 2006.

Polar Vortex Hits The Markets Too

The stock market kicked off 2014 with a (so far) shallow bout of weakness which we don’t consider to be the start of a new cyclical bear market or even a deep correction.

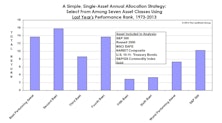

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

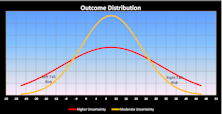

Looking Deeper Into The Tails Of Distribution

Leuthold’s Eric Weigel examines both positive and negative tail risk among asset classes over two time periods… the recent volatile era versus a preceding, not-as-volatile time period.

Small Cap Outperformance: More Questions Than Answers

Small cap out performance so far in 2008 is baffling. Earnings growth has been weak relative to large caps and valuations are still excessive. Interestingly, EAFE Small Cap Index is underperforming, while its U.S. counterparts are doing well.

Small Caps Succumbing

Why have Small Caps been outperforming Large Caps since January?

Small Caps' Stumble Is A Global Affair

Small caps have trailed the S&P 500 performance by 12-15% since peaking out on a relative basis in the spring of 2006. International small caps have broken down even more decisively on a relative basis.

Bad Breadth Is A Global Concern

Bad breadth is a global concern. It may come as a surprise that foreign breadth is actually weaker than U.S. readings.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)