Equal Weight

Be Contrary On Discretionary

The Fed’s June announcement of a pause with further rate hikes to come has extended the uncertainty of whether an inverted curve and persistent policy tightening will ultimately lead to a recession. The business cycle is a critical investment issue because the relative returns of many assets depend on the state of the macro economy. This study examines the Consumer Discretionary (CD) sector’s behavior in recessionary times, with the goal of understanding the typical performance pattern during economic lows in order to help investors position their portfolios for a potential recession.

Research Preview: Recessionary Discretionary

While sentiment on the potential for a recession by year-end is split, there is little dispute that it’s an important question for cyclical sectors. Consumer Discretionary is most exposed to the business cycle, and we are interested in understanding its prospects as we head toward a potential economic slowdown.

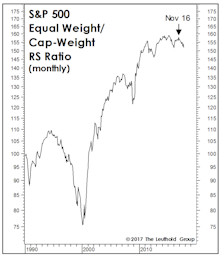

Cap Weight Or Equal Weight?

The Equal Weighted S&P 500 now trails the S&P 500 by 400 basis points YTD, and the rally is increasingly assailed as too narrow.

Additional Factors

From the lows on February 11th to the end of March, the S&P 500 rallied nearly 14%, propelling the index into positive territory for the YTD. Our Equal Weighed Average sprung back to life in the past two months; the largest handful of firms are no longer driving performance.

Additional Factors

S&P 500: Best Month In Four Years

Stock Market Observations

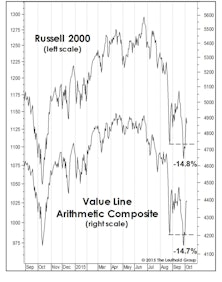

The August market break did not emerge from out of the blue. The foundation for the bear case was put in place many months before those four ugly days in late August.

Additional Factors

S&P 500: Worst Month In Three Years

Additional Factors

S&P 500: Largest Firms In Charge

Additional Factors

After rattling off nine consecutive quarters of gains, the S&P 500 quarterly winning streak is no more. We have to go way back to 1995-1998 to find a more impressive stretch (14 consecutive quarters).

Additional Factors

Gainers outnumbered losers by more than 2 to 1 for the largest 25 firms, while the overall market turned in uninspired results. Still, Q2 is off to a positive start for the S&P 500 as we look for the 10th consecutive quarter of gains for the index.

Additional Factors

S&P 500: Home On The Range

Additional Factors

Our Equal Weighted measurement slightly outperformed the Cap Weighted index and now leads by 50 bps for the year.