Fixed Income

Meanwhile, In “Relative World”...

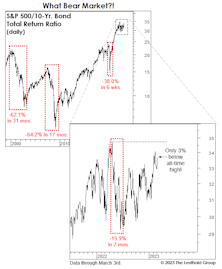

A large swath of the institutional asset-allocation world is engaged in the sometimes dangerous, binary game of “stocks versus bonds.” Although the 2022 bond debacle caused relatively mild damage to a massively overweight equity position, the bear markets of 2000-2002 and 2007-2009 produced losses for stocks versus bonds that exceeded 60%.

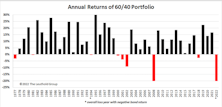

Research Preview: The 60/40 Skeptics Were Right

The 60/40 strategy is having a terrible year, and its failure to protect investors in the bear market prompted us to take a look at the history and theory of the 60/40 guideline. We offer an early preview of the study, with a focus on 2022’s abysmal year-to-date returns.

U.S. Bonds

Given the higher volatility and increased risk aversion, high grade credits are attractive as the negative relationship between rates and credit spreads dampens the volatility of this asset class.

U.S. Bonds

The thin liquidity likely magnified the move in both rates and credit spreads, but we continue seeing a friendly macro environment that supports high quality credits.

US Bond Grades

The renewed participation of credits in the risk asset rally is a welcome sign.

U.S. High Yield Corporate Bonds: Maintain Neutral

On the positive side, the fundamental picture is still healthy for most U.S. high yield issuers, and defaults are expected to be low. On the negative side, weakening inflation expectations is a divergence that bears close monitoring. We will exercise patience and wait for a better entry point.

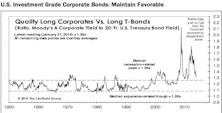

U.S. Investment Grade Corporate Bonds: Maintain Favorable

This is consistent with our overall cautious view on credits. Credit spreads continued narrowing despite higher volatility in the bond markets.

U.S. High Yield Corporate Bonds: Maintain Neutral

Over the past few months we’ve seen the largest high yield bond fund outflow since 2000. We will exercise patience for now and wait for a better entry point.

U.S. Investment Grade Corporate Bonds: Maintain Favorable

Despite the exodus from all bond classes in the last few months, longer term demand for safe spreads is likely to remain strong and investment grade issuance has dropped significantly.

The Math Doesn’t Work For Long-Term Treasuries

The recent upside breakout in the U.S. 10-year yield was successful, and it appears interest rates will remain in the new higher range for now. But what are the short-term implications of higher U.S. Treasury rates on asset allocation decisions?

Not As Bad As January...

First, let us be thankful February 29th only occurs every four years. No, we haven’t done a historical performance analysis of past leap year extra days, but you can be certain somebody now has. Whatever, it was a bad end to February 2008.

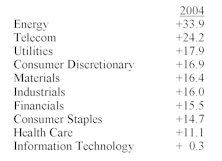

Did You Have The Right Mix In 2004?

Small Cap Stocks were hands down winners relative to large caps, while just edging out mid caps. This is the fifth consecutive year of small cap superiority.

Bond Market Summary

The U.S. economy still has considerable momentum, but there are now more signs of a slowdown ahead. Global economy is slowing down even more.

Bond Market Summary

Economy still has considerable momentum, but there are signs of a slowdown in the second half. Still expect further Fed tightening. Expect inflation rates of change to soon peak, then cool off in Q4.

Bond Market Summary

· Still expect one more rate hike due to rekindling of stock market enthusiasm, prospects of accelerating inflation, and reported wage inflation numbers understated.

Bond Market Summary

Despite weaker economic news, still expect Fed to bump rates up at least once more.

Bond Market Summary

Further Fed tightening to come…..Next few month inflation news likely to be scary.

Bond Market Summary

Strong economic news, and rising inflation trends make further Fed tightening almost a certainty.

Bond Market Summary

Strong economic news, and rising inflation trends make further Fed tightening almost a certainty.

Bond Market Summary

Yield curve inversion reflects supply/demand dynamics, expectations of further Fed tightening and unwinding of short strategies by speculators.

Bond Market Summary

Strong economic news, and rising inflation trends make further Fed tightening likely.

Bond Market Summary

Rising stocks and still good economic news make third Fed boost likely.

Bond Market Summary

Rising stocks and better economic news could increase chance of third Fed boost near term.

Bond Market Summary

Two recent bump-up’s in rates by Fed may not be enough.

Bond Market Summary

Last month’s 25 basis point bump-up by Fed will not be the last. More tightening seems likely.

Bond Market Summary

Recent 25 basis point bump-up by Fed will not be the last. More tightening seems likely but T-bonds now look to be in the high end of a buying zone.

Bond Market Summary

Strong likelihood the Fed will tighten in next few months, but today’s market rates may already factor in future 25-50 basis point Fed bump up in short rates.

Bond Market Summary

New inflation fears and strong economy contributing to higher yields. Think Fed may tighten (50% likelihood) in coming months to slow down amazing economy.

Bond Market Summary

New inflation fears and strong economy contributing to higher yields. Fed may tighten in coming months to slow down this high powered economy.

Bond Market Summary

Big Rise in Treasury yields has resulted in improved risk/reward profile for T-bonds.

Bond Market Summary

At current levels U.S. T-bonds are viewed as neutral. U.S. T-bond upside potential now only slightly above downside potential.

Bond Rally Lost Its Punch In March

Weight of the evidence bond market discipline shifted to negative from neutral this month.

Economy Showing No Signs of Cooling Off

Economy Humming Along...Fed Not Done Yet...Inflation Still Number One Worry

Inside the Bond Market

Weight of the evidence discipline remains negative on a cyclical basis, but long T-bond six month risk seen only as 8.25%-8.50% level, with 12 month risk at 8.50% level.

Inside the Bond Market

Weight of the evidence discipline remains negative on a cyclical basis, but long T-bond six month risk seen only as 8.25%-8.50% level, with 12 month risk at 8.50% level.

Inside the Bond Market

Weight of the evidence discipline remains negative on a cyclical basis.

Inside the Bond Market

Weight of the evidence discipline remains negative on a cyclical basis, but rally seems underway.

Inside the Bond Market

Weight of the evidence discipline remains negative.

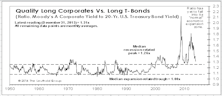

Bonds: Guaranteed Long Term Underperformance???

Time for an attitude adjustment? We have seen some fat returns on long fixed income securities since rates peaked in 1981. What can we expect from bonds in the future? To help answer this question we look at three sample bonds using a 5 and 10 year risk/reward framework.