Foreign Stocks

Our Annual Lament On Foreign Equities

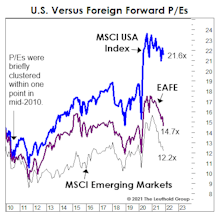

There should be a name for the syndrome suffered by foreign stock investors over the last decade or so. “Groundhog Day” doesn’t quite cut it, because that event repeats only once a year. It seems like this time of year we always feature a chart showing a healthy YTD double-digit gain in the S&P 500, along with a bond-like gain in EAFE, and a bond-like gain or loss in the MSCI Emerging Markets Index.

A Good Thing To Have In Reserve

It seems investors care mostly that the authorities have fiercely defended the S&P 500’s status as the World’s Reserve IndexTM. A decade of QE should have taught us that when the Fed conducts a decade’s worth of QE in little more than a year, U.S. Large Cap stocks benefit the most.

“Provincialism” Pays

After the last two months’ violent reversal of the “re-opening” trade, the major indexes for U.S. Large Cap, Small Cap, Growth, and Value all stood with YTD gains in the 14-16% range. Yes, a few nimble portfolio managers might have migrated out of “re-opening” stocks in early April and into the “old” Large Cap Growth leadership but the surest route to superior performance has been to avoid what’s become an almost annual pitfall since the Great Financial Crisis: Foreign stocks. EAFE and MSCI Emerging Markets already trail the S&P 500’s 16.0% YTD gain by about 8% and 12%, respectively.

Visualizing U.S. Stock Market Dominance

It’s near the year’s mid-point and U.S. equities are doing what they’ve done nearly every year since the onset of the Great Financial Crisis: trouncing their foreign counterparts. The S&P 500’s YTD gain of 13.5% is about 500 basis points better than EAFE’s, and 800 basis points above that of the MSCI Emerging Markets Index.

Foreign Stocks Party Like It’s The “2010s”

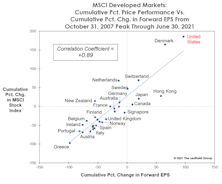

The most likely catalysts for improved relative performance of foreign stocks would be: (1) a bear market; (2) a recession; and, (3) a major downturn in the U.S. dollar. This year has supplied all three, yet the relative strength ratios of most foreign equity composites continue to grind lower as if it’s “business as usual.”

New Year, Old Leadership

We’ve written at length about a bear market’s tendency to catalyze major leadership changes—across sectors, styles, and even geographies.

Sizing Up The Rally

There’s an old saying that bear market rallies look better than the real thing, yet the upswing off December lows looks even better than the typical bear market rally.

The Downside Leaders Look Familiar

It wouldn’t be a December Green Book without at least one page of hand-wringing over the year’s extreme underperformance of foreign stocks.

The Foreign Stock Conundrum

A good rule of thumb for thematic and sector investors is that stock market leadership rarely repeats itself in consecutive cycles.

Global Valuation Checkup

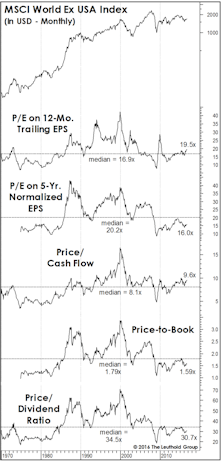

Foreign equities beat the U.S. in the first quarter, but the performance gap that’s opened up since the 2007 market highs remains astounding. While foreign equity valuations (especially within EM) have rebounded from February 2016 lows, the bounce has done little to close the enormous P/E discounts relative to the U.S. market.

Foreign Equities: Cure For Altitude Sickness?

When we complain about the stock market’s inflated valuation levels, we’re unintentionally giving short shrift to the 50% of the global-market capitalization that resides outside the U.S. We’d be hard-pressed to describe the valuation of Developed foreign markets as any higher than neutral.

Are There Better Values Abroad?

The United States’ large P/E premium relative to the rest of the world suggests that foreign equities should produce total returns of about two percentage points (annualized) above the U.S. over a seven to ten-year horizon.

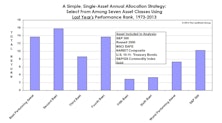

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

The Crowd Goes International

Savvy U.S. professional investors have been buying foreign stocks for a number of years now. Somewhat more recently, pension funds have been focusing on foreign diversification. Now mutual fund investors have become increasingly enamored with foreign stocks.

The Investment Case for New Zealand Stocks

By traditional measures, the New Zealand stock market is the most undervalued market in the developed world. As of this issue we are incorporating a 6% package of New Zealand stocks into our asset allocation models, both the conventional and the unconventional.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)