High Yield

US Bonds

Net outflows continued as the cushion from credit spreads is still inadequate...So far risk contagion from the Puerto Rican bond default has not been an issue. Munis still look attractive relative to Treasuries, and investment grade Corporates...The improvement in credit markets and inflation expectations looks more shaky as oil prices broke below the recent tight range and uncertainty around Greece adds to the overall risk aversion. We reduced these bonds to Unfavorable.

US Bond Market

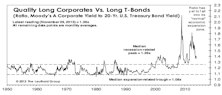

Although the overall picture remains favorable for high grade credits, the increased exposure to interest rates with an ever thinner spread cushion does concern us. We will monitor closely for potential downgrades.

U.S. Bonds

Given the higher volatility and increased risk aversion, high grade credits are attractive as the negative relationship between rates and credit spreads dampens the volatility of this asset class.

US Bond Grades

The renewed participation of credits in the risk asset rally is a welcome sign.

US Bond Market - October 2013

We are encouraged by the narrower spreads in October as the feared divergence between credits and equity markets did not continue.

Our Position on U.S. Bonds

U.S. Investment Grade Corporate Bonds: Favorable, U.S. High Yield Corporate Bonds: Neutral, U.S. Municipal Bonds: Neutral

U.S. High Yield Corporate Bonds: Maintain Neutral

On the positive side, the fundamental picture is still healthy for most U.S. high yield issuers, and defaults are expected to be low. On the negative side, weakening inflation expectations is a divergence that bears close monitoring. We will exercise patience and wait for a better entry point.

U.S. High Yield Corporate Bonds: Maintain Neutral

Over the past few months we’ve seen the largest high yield bond fund outflow since 2000. We will exercise patience for now and wait for a better entry point.

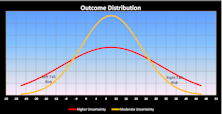

Looking Deeper Into The Tails Of Distribution

Leuthold’s Eric Weigel examines both positive and negative tail risk among asset classes over two time periods… the recent volatile era versus a preceding, not-as-volatile time period.

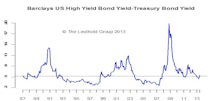

Time To Take Some High Yield Bond Profits

High Yield bonds are still rated Attractive, but the spreads have narrowed significantly.

High Yield Bonds: Start Accumulating

High Yield bonds have reached our attractive zone at yields of nearly 14%. To us, a gradual accumulation program makes sense.

Better Than Bonds?…..Stocks That Yield More Than Ten Year Treasury Notes

Tax disadvantaged REITs might now compete with tax advantaged high yielding non-REITs. We provide a list from a screen identifying high yielding non-REIT stocks.

Bond Market Summary

We believe it is still an opportune time to add to High Yield positions. The economy is improving and corporate profits are rebounding from depressed levels.