Junk Bonds

Credit Cracking?

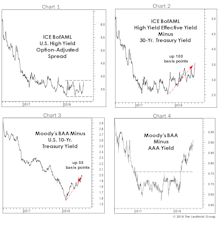

One of the key pillars of the bullish case has been the supposedly “benign” trend in corporate credit. While that’s been true for holders of the popular junk bond ETFs (HYG and JNK), the broader credit picture is not as reassuring.

Trouble Is “Spreading”

Junk bond option-adjusted spreads (OAS) have remained relatively tight throughout the stock market pullback and recovery (Chart 1), assuring some bulls that the action is nothing more sinister than a “healthy and overdue” correction.

An Alarming 2008 Analogy?

While breadth and leadership accompanying the upswing off February lows have been impressive, the most outstanding feature of this advance might be the confirmation provided by high yield bonds.

Charts That Challenge Us…

While our disciplines continue to turn up enough bullish evidence to keep us cautiously positive toward stocks, we are seeing troubling signs by cyclicals (especially the Transports) and junk bonds.

The Reach For Yield… And Its Consequences

Investor infatuation with portfolio income is higher than ever, just as there is less of it available than at any time in history.

Buckle Up For The “Doldrums”

Beware summer doldrums, August has a knack of sometimes being a crazy month. Market continues to be viewed as being in a severe correction mode, rather than a full fledged bear market.

Rising High Yield Spreads....Implications For An Agnostic Stock Market

Link between Junk bonds and stock market seems to be indicating that stock investors are ignoring factors pushing Junk bond yields higher.

View From The North Country

August was comparable to flying through a category five hurricane, a violent storm with gut wrenching updrafts and downdrafts. The relatively low volume recovery from the August lows has the characteristics of a bear market rally, not the beginning of another major move to the upside.

Below Average Returns May Be Expected When Junk Bond Yields Fall Below 9%

New study by The Leuthold Group suggests below average High Yield bond returns can be expected when Junk yields fall below 9%.

Bond Market Summary

Is the Fed ready to buy Ten Year Treasuries, if necessary to stimulate the economy? This could certainly lead to another housing/refi boom, but will it be the catalyst to boost business spending/borrowing? We think not.

View From The North Country

“What? You’re buying MORE Junk Bonds?!” “Regulation FD” could ultimately improve the depth and quality of analyst research, turning the focus back to more relevant, longer term outlooks. “Sell Side” Stock Research: The reasons why we no longer use it.

View From The North Country

“What? You’re buying Junk Bonds?!” Although some may view this as a high-risk, contrarian bet, the logic behind the strategy is explained.

Bond Market Summary

The bond market, helped out by some good CPI and PPI numbers, scored typical net gains of 2+ points in May. Long bond yields, corporates, treasury zeros and treasury coupon bond yields fell 20 basis points....all in all, a pretty good month.

Bond Market Summary

The bond market continued to edge higher in the first part of April, but then the Chicago River drained the T-bond market of its liquidity, flooding out T-bond and T-note futures trading.

Bond Market Summary

For the month of April, higher quality long bonds turned in small fractional gains. The economic tea leaves were mixed, inflation numbers were good, the dollar held up and short term rates came down. However, a big pick up in new fixed income offerings seemed to satisfy investor demand.

Bond Market Summary

In March, the fixed income markets were a mixed bag. Short term rates fell 25 basis points and 90 day bills ended the month well below 6% (5.74%). Junk bonds extended their sharp February rally. Outside of short term rates and junk bonds, the fixed income markets recorded little net change in March.

Bond Market Summary

Inflation continues to cool and the economy is providing more evidence of slowing, but we still have our reservations about the bond market and remain cautious.

A Potential Tactical Move Into Junk Bonds

It still appears to be premature, but we are giving serious consideration to adding a package of selected high yield corporate bonds to the fixed income component of the two asset allocation models.

Bond Market Summary

For quite some time this publication has had a pretty good feel for the bond market. But May surprised me. My expectation was a stronger market early in the May followed by a correction.

Bond Market Summary

With at least some preliminary signs the economy is slowing, accompanied by more comforting PPI and CPI numbers, it would appear the Fed is relaxing a bit.