Low Volatility

The Calm After The Storm

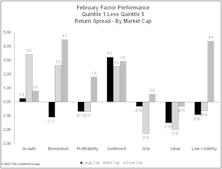

Factor performance stabilized in February, recovering from a brutal start to the year. While those dynamics bled into the first two days of February, the trend quickly reversed as interest rates bounced off recent lows and stayed on an upward trajectory for the rest of the month.

Factor Returns And A Basket Of EGGs

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Ruminations On The Fed, Past And Present

If the “Maestro’s” image was dinged from being the “original bubble-blower,” imagine what will happen to Jay Powell’s if stock valuations mean-revert alongside interest rates and inflation over the next few years.

The Chart Everyone Missed

When we first met Steve Leuthold in the old company office in a renovated warehouse, he was updating a several-foot-long chart of either the DJIA or S&P 500, by hand, and we got a brief lecture on the importance of using logarithmic scale on price charts.

Utilities Sector: What’s Driving YTD Performance?

We review the somewhat out-of-character performance of the Utilities sector to try to pinpoint what is influencing results. This article touches on several potential drivers for the sector’s relative strength.

The Odd Couple

The Momentum style—in which investors buy what has been going up recently—represents an optimistic, hopeful, “I’ll take some of that” mentality. The Low Volatility factor entails a pessimistic, fearful outlook in which investors want (or need) to stay invested in stocks but desire downside protection in case the market performs badly.

The Stock Market’s Clark Kent

Mild-mannered and humdrum on the surface but a superhero underneath—that’s Clark Kent and, in recent months, the Low Volatility factor. Low Vol stocks are unexciting by definition, and the factor’s current holdings focus on utilities, REITs, and insurance companies.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)