Market Cap Performance

A Fond Remembrance Of Y2K… And Great Values

We’ve participated in this year’s upside market surge, while at the same turning a bit wistful in remembrance of a simpler and saner stock market era—an era when one could buy more than a third of the Leuthold 3000 stock universe for less than 14x earnings. Yes, that’s the comparative period of stock market sanity that existed in late February 2000, just days before the NASDAQ Composite made its historic bubble-era peak.

Small Cap vs Mid Cap vs Large Cap

Small Cap Premium Jumps to 12%

Capitalization Tier Meausres

Continuing to evaluate Leuthold Index methodology.

Capitalization Tier Meausres

Continuing to evaluate Leuthold Index methodology.

Capitalization Tier Meausres

Continuing to evaluate Leuthold Index methodology.

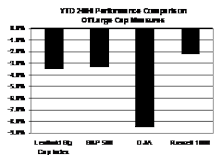

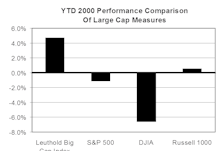

Large Cap Versus Small Cap: Inside The S&P 500

Poor performance by Large cap technology issues had a very negative impact on S&P 500 cap weighted performers in 2000.

Capitalization Tier Meausres

Continuing to evaluate Leuthold Index methodology.

Capitalization Tier Meausres

Continuing to evaluate Leuthold Index methodology.

Capitalization Tier Meausres

Currently evaluating Leuthold Index methodology.

Capitalization Tier Meausres

Currently evaluating the Leuthold Index methodology.

View From The North Country

Dividends do matter, especially as an important component of total return. Also, a recent study published in the Financial Analyst Journal tries to get at the root of large cap, growth stock dominance in the 1990s.

Capitalization Tier Meausres

Currently evaluating Leuthold Index methodology.

Capitalization Tier Meausres

The Leuthold Group has set out to create a more realistic assessment of Big, Mid, Small, and Micro cap performance.

Capitalization Tier Meausres

The Leuthold Group has set out to create a more realistic assessment of Big, Mid, Small, and Micro cap performance.

Capitalization Tier Meausres

The Leuthold Group has set about to create a more realistic assessment of Big, Mid, Small, and Micro cap performance.

Capitalization Tier Meausres

The Leuthold Group has set about to create a more realistic assessment of Big, Mid, Small, and Micro cap performance.

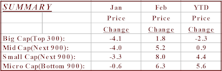

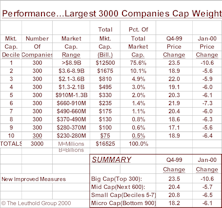

New Capitalization Tier Measures

New Leuthold Capitalization Tier performance measures explained and detailed.

Performance By Cap Tiers...Our New Measures

S&P 500, S&P 400, and Russell 2000 may not always present accurate readings of Big cap, Mid cap and Small cap performance, respectively.

New Improved Performance Measures For Capitalization Tiers

Today’s popular stock indices may be overweighted toward tech.

1999 Performance: Big Caps Versus Small Caps

Small cap performance actually nosed out Big Cap +19.6 for Russell 2000 and +19.5% for S&P 500 (price only). Who would have believed it?

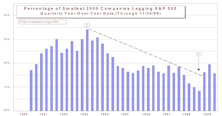

Tracking Shifts In Market Capitalization Leadership

A unique way to monitor and react to changing stock market capitalization leadership trends. This new study examines the percent of stocks lagging the S&P 500, segmented by capitalization tiers.

Beating The S&P 500...Q3 Update

Large Cap and Growth was where you needed to be in the first nine months of 1999.

Making The Case For Mid Caps

For managers who are mandated to stay fully invested, Mid Caps make pretty good sense as a replacement for extremely overvalued Nifty Fifty stocks.

View From The North Country

Transcript from late February conference call with Steve Leuthold and Byron Wien covering a wide spectrum of timely investment topics.

The Dichotomy Continues...Big Cap Versus Small Cap

Q1 1999 following the same market script of 1995-1998, with big cap stocks, especially Nifty Fifty types, dominating smaller companies in terms of market performance.

Big Cap Dominance…More Striking After July Turmoil

The second half of 1998 got off with a thud for most managers. It is becoming increasingly evident that we are in a two tiered market—the only positive relative performance is from the largest of the big cap “growth” stocks.

Earnings Momentum From A Market Perspective

Jim Floyd maintains a continuing earnings momentum monitor for a universe of 3000 stocks, breatking the universe down into tiers based on market capitalization.

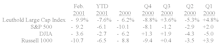

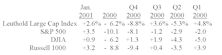

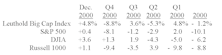

Big Cap Versus Small Cap: S&P 500 Versus Russell 2000

The following table compares the performance of the Russell 2000 Index since its inception in 1979 with the S&P 500.