Market Conditions

Are You Better Off Than You Were Forty Years Ago?

Old timers will recognize our title as a twist on Ronald Reagan’s clincher in the final 1980 presidential debate with Jimmy Carter.

We recalled Reagan’s line while preparing for today’s 40th anniversary of the great 1982 secular stock-market low. Investors in the S&P 500 have earned an annualized total return of +12.4% since that trough, about two percentage points above the long-term average.

The Active/Passive Performance Cycle Second Quarter 2022 Update

The performance derby between actively-managed portfolios and passively-managed index funds is a topic of ongoing interest for Leuthold clients and the investment community at large. Therefore, we are providing an update to all charts and tables of our Active/Passive performance analyses.

Tis The Season For Factor Tilting

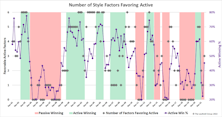

Factor investing has gained wide popularity in recent years, enabled by a proliferation of smart-beta ETFs coming to market, which opened new opportunities for tactical investors. In 2018, we launched our Factor Tilt ETF strategy, and here we discuss how we’re now enhancing it by adding Seasonal Cyclicality to our analytical toolbox for evaluating factor conditions.

Schrödinger’s Style Box

The performance derby between actively managed portfolios and passive benchmarks is strongly influenced by market conditions. Active manager success rates are cyclical, but not random, and are driven by slippage created from style, size, and weighting considerations that result from the imperfect slotting of active portfolios into single style boxes. Moreover, this slippage can be defined and measured, and shows a clear correlation with relative return spreads between benchmarks and their opposite boxes.

Leuthold Factor Tilt Update

Factor analysis is a point of emphasis in Leuthold’s tactical research activities, and this note summarizes our Factor Tilt outlook going into the fourth quarter. Factors are return drivers such as Value, Momentum, and Quality, and research has found that factor results vary over time—but that does not mean they are random.

A Small Cap Strategy Session

Leuthold’s research team has recently flagged a number of items that suggest it may be time to consider small cap stocks. This asset class has been showing signs of life and the decision to overweight small caps is starting to seem relevant – and perhaps nicely profitable - again.

Owning S&P 500 At 2,900 In 2018 Vs. 2019

A look at underlying conditions at each stage of the bull market.

Where Would You Rather Be?

On October 3rd, the S&P 500 briefly traded below the high it made in January 2018 before reversing to close the day higher.

Factor Tilts at Mid-Year

Factors provide investors with the ability to shift their portfolio’s characteristics to fit a particular economic and market outlook. Value might look appealing under one set of conditions while Quality might be more desirable in another. We developed a research platform that analyzes various drivers of factor returns, summarized in Exhibit 1.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)