Normalized Earnings

Normalize This!

The sell-side is at it again, publishing a one-year ahead “Adjusted” EPS figure for the S&P 500 that is unlikely to be achieved—and then affixing P/E multiples seen near an historic market peak to “capitalize” on those unlikely earnings.

Time To Revisit “Why We Normalize Earnings”

With an economic calamity and the Easter season upon us, we thought this would be a great time to resurrect our “Why We Normalize Earnings” vignette. Long time readers will recognize this as a staple from Green Books’ past.

Small/Mid/Large Cap Internals

Small Caps are selling at a 20% valuation premium relative to Large Caps, using non-normalized trailing operating earnings.

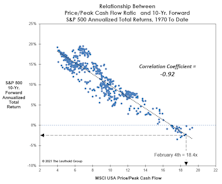

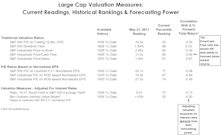

Assessing Stock Market Valuation Tools: Which Work—And Which Don’t?

“Of Special Interest” this month evaluates several stock market valuation techniques. Newfangled valuation techniques do not always lead to better results.

Smoothing Out The Cycle… And The “Psyche”

Fundamental rationales also have strong psychological elements. Normalizing earnings helps minimize the startling impact of declining earnings.

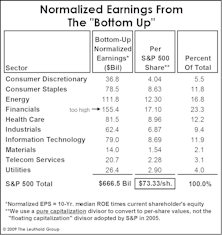

A "Bottom Up" Look At Normal Earnings

We’ve been receiving a lot of client questions on normalizing earnings. We take a look at a “Bottom Up” approach and give a simplistic description of our approach.

Normalized Earnings…..A Primer

Normalized P/E ratios show stock market to be cheap, but what are “normalized earnings”? We present our methodology and rationale is this month’s “Inside The Stock Market” section. While U.S. stocks are cheap, foreign stock markets look even cheaper.

Time To Revisit "Why We Normalize Earnings"

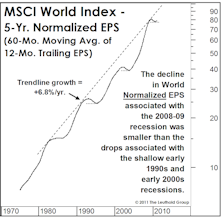

Earnings are very cyclical by nature, the ebb and flow can cause P/E ratios to move in erratic, less meaningful ways.

View From The North Country

Steve Leuthold discusses the rationale for using “normalized” earnings versus 12-month earnings and how it now makes little sense to sell in May and go away…..unless you need a long vacation.

Is The Stock Market's Current P/E Dangerously High?

It is possible for new bull markets to emerge from high P/E levels. Earnings are cyclical, so when earnings decline in a recession, it can mark a very good buying opportunity despite high P/Es.

Valuations Are Sky High…How Can The Leuthold Group Be Bullish?

An explanation herein, with the use of our trusty histograms.

Dealing With The Earnings Quagmire

A review of how companies can manipulate their earnings.

Normalizing Earnings Is Now Essential

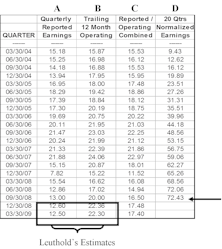

Earnings are cyclical and the economic cycle causes distortions. A focus on which earnings to use and how to evaluate the differences.

Tech Watch…..S&P Tech Subset Down 12% In August

Can there be a significant market rally without a tech rally? Maybe not. S&P 500 tech weight (16.9%) now slightly below our “normal” target weight of 17%.

The Importance Of Normalizing Earnings

Earnings are cyclical! This becomes especially obvious near peaks and troughs.

Normalizing Earnings...Decycling and Determining Underlying Earnings Power

Earnings normalization of some type is essential when making historical relative P/E comparisons. The more cyclical the earnings of a market index (or an individual company) the more important normalizing or smoothing becomes.

How Much More Is in This Market?

Clients are asking how much more is in this market? Herein we will attempt to provide an answer to this question, without the aid of charts, astrology, or Evel Knutson. Rather, we will employ over 60 years of historical valuation facts.

The DJIA Is Selling at Over 50 Times Earnings

The P/E for this most popular market measure is incredibly distorted by a handful of component stock. When will Dow Jones bite the bullet and improve this index?