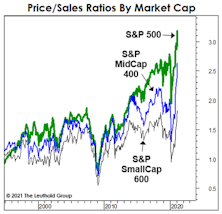

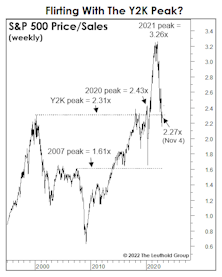

Price-to-Sales

Valuation Mirage?

Thanks to the 2009-2021 experience, an entire generation of investors can’t distinguish between a stock market that’s down in price and one that’s actually “cheap.” The current bear market seems on course to make that distinction relevant again.

A Flight Of Wee Dragons

In our mid-month Of Special Interest, “Valuation Extremes: Here Be Dragons,” we examined valuation outliers as a measure of market sentiment. The hypothesis was that exuberance is reflected in investors’ willingness to hold stocks priced on an aggressive “vision” of the future; companies that are either habitually unprofitable or trade at a Price/Sales ratio above 15x.

Valuation Extremes: Here Be Dragons

Top decile valuations are often the result of unduly positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Because bullishness manifests itself in aggressive valuations for speculative companies, we believe the prices being applied to such companies - for which intrinsic value is dependent on a future that looks significantly different than today - are an excellent measure of investor sentiment. In that spirit, we examined past cycles of extreme valuations with the goal of understanding how they relate to investor sentiment and what they might tell us about market conditions and relative returns.

Bureaucratic Bull

Twenty-one years ago, the bullish bets were on publicly-traded businesses (especially ones with dot-coms after their names). In contrast, today’s bulls seem more beguiled by bureaucrats—the central bankers who, having saved markets and the economy from catastrophe in the last year, are assumed to have mastered the business cycle.

Research Preview: A Tale Of Two Tails

Top decile valuations, such as those in place today, are usually the result of excessively positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Leuthold research typically tracks valuation sentiment by examining median P/E ratios, but in this study, we are taking the opposite tack. Rather than looking at medians, we are focusing on the outliers in each tail of the valuation distribution.

.jpg?fit=fillmax&w=222&bg=FFFFFF)