Quantitative Tightening

Was That A Pivot?

Stock market monetary- and liquidity conditions over the last year have been the harshest we’ve seen in a 33-year career, and consistently the largest drag on the Major Trend Index (even overshadowing valuations!).

Pause, Then “Paws?”

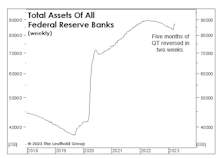

Despite the Fed’s tough-talk about getting the funds rate above 5%, monetary and liquidity measures are significantly less bearish. Thank SVB depositors, who required a bailout big enough to reverse five months of QT in just two weeks. The market reaction looks like that after September 2019’s Overnight Repo-market turmoil, which forced the Fed to end its first experiment with QT.

Your “Free Lunch” Comes With A Tab

The market impact from money printing has been underwhelming when adjusted for the inflation it’s unleashed. Measured from the peaks associated with the first attempt at Quantitative Tightening, in inflation-adjusted terms, Small Caps, EAFE, and Emerging Markets all have losses.