Recession Risk

Fooling Ourselves?

In early September, the co-founder of one of the largest U.S. private equity firms declared that predicting recessions is a “fool’s errand.” We couldn’t disagree more.

Don’t Let Economists Work From Home…

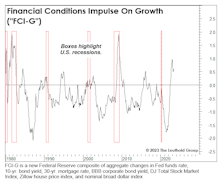

Last month, we noted that Jay Powell’s preferred measure of the yield curve—Near Term Forward Spread (NTFS)—was a winner, but a newly introduced index by the Fed, “Financial Conditions Impulse on Growth (FCI-G),” is a dud. Several simple forecasting gauges we’ve relied on for years are considerably more effective.

Pretty Darn Neutral

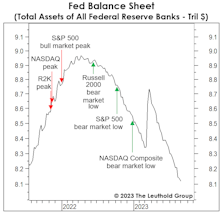

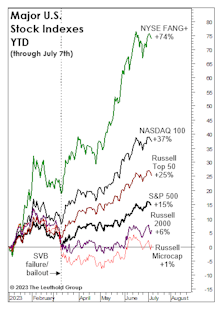

Last month’s title, “Echoes of 2021,” didn’t fully capture the speculative fervor that’s gripped big Technology stocks—and the NYSE FANG+® Index immediately set out to rectify that shortfall by tacking on another 5% to bring its YTD return to +74%.

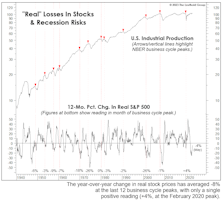

Watching The Wealth Effect

“Real” stock-market wealth has declined considerably since late 2021 without yet delivering a knockout blow. But if the other key evidence detailed throughout this section is on the mark, that wallop is lurking in the very near future.