Relative Returns

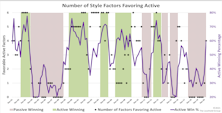

Research Preview: Is “Manager Skill” Cyclical?

The active-passive performance derby is cyclical, determined not by the ebb and flow of portfolio managers’ brilliance but, rather, by market conditions and the slippage that arises from imperfectly comparing funds and benchmarks.

Valuation Extremes: Here Be Dragons

Top decile valuations are often the result of unduly positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Because bullishness manifests itself in aggressive valuations for speculative companies, we believe the prices being applied to such companies - for which intrinsic value is dependent on a future that looks significantly different than today - are an excellent measure of investor sentiment. In that spirit, we examined past cycles of extreme valuations with the goal of understanding how they relate to investor sentiment and what they might tell us about market conditions and relative returns.

Research Preview: A Tale Of Two Tails

Top decile valuations, such as those in place today, are usually the result of excessively positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Leuthold research typically tracks valuation sentiment by examining median P/E ratios, but in this study, we are taking the opposite tack. Rather than looking at medians, we are focusing on the outliers in each tail of the valuation distribution.

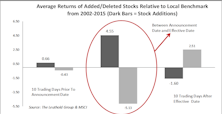

Index Rebalance Effect—A Disappearing Anomaly?

In the past we’ve made the observation that adding/deleting stocks to/from a popular index can have a profound impact on the target stocks’ short-term trading volume and performance.

Valuations & Future Returns

The U.S. market rates anywhere from mildly overvalued to very overvalued relative to other developed markets. Foreign markets might be the last remaining pocket of yield that isn’t overvalued.