South Africa

Can The EM Problem Spread To DM? Yes, If It Gets Bad Enough

The current EM weakness is not yet a full-blown crisis but, if it does become one, it will drag down developed economies too.

Emerging Markets: Dismal 2013, Hopeful 2014

What worked, what didn’t; what you need to consider for investing in Emerging Markets this year.

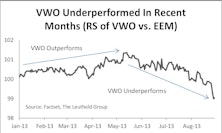

Navigating Reversals In The Emerging Markets

Identifying opportunities given this summer’s momentum reversals and currency vulnerabilities.

View from the North Country

Politics and the Stock Market...Fiscal Reform the Hard Way...What's Up With Gold (Not Much except a Weak Dollar)...Eskom (South Africa's Electric Utility) Bonds: A 20% Yield with Some Risk As Well

Update: South African Hit List Index

This is an index developed in the summer of 1985 made up of U.S. stocks potentially most subject to South African divestiture selling pressure. It includes companies given bad Sullivan ratings and those who have not become signatories. A.D. Little released new Sullivan ratings Nov. 1 and there have been a number of changes.

An Index of Primary South African Divestiture Candidates

New Jersey’s recent legislation requiring state pension fund divestiture of South African connected stocks may be a landmark. We have compiled a list of 73 stocks that may well be the primary targets for additional divestiture selling by other funds, our Divestiture Hit List.

Gold and Gold Stocks

Prudent investors should include gold in their long-term portfolio asset mix considerations. Most don’t, but they should. However, our intermediate term outlook for the price of gold is not all that optimistic. Nevertheless, we think the aggressive investor is currently being presented with an attractive capital gains opportunity in South African gold shares.

Update: South African Connection Stocks

There have been a number of requests for more information on companies doing business with and investing in South Africa. We have spent considerable time over the past month on this investment morality play. Public pension funds are under increasing pressure, but I am coming to believe the ultimate course will be a boycott against buying offending companies, not divestiture.

View from the North Country

South African Divestiture: The campaign against investing in companies doing business with South Africa is rapidly building momentum…TV Tulips: Recent prices paid for commercial TV properties may be tulip bulb prices… Will It Take a Crisis?: I am just about convinced that only a crisis can bring meaningful fiscal reform.