Taper

Fed Taper—Not A Policy Error

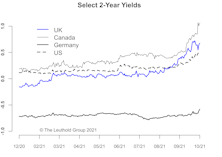

We believe concerns about central-bank policy error are mostly a foreign issue, because they have moved much more aggressively than the Fed. The market has shown no indication of a Fed-policy mistake and we are still on board with the reflation trade.

10-Year Yield: More Downside

We expect the 245-250 barrier to be tested, and if it is decisively broken, much lower yields could be in the cards.

U.S. 10-Year: 245-250 Area A Strong Barrier

We expect the 245-250 area, the upper bound of the previous lower range, to be a strong barrier.

A Taper & Hibernating Bears

The rise in interest rates after the taper was on the back of low liquidity around the holidays. 3% is a pretty strong upper bound for the 10-year, and a failure to stay above this level will probably see a re- test of the 275 level in the near term.

10-Year: No December Taper, Back To The 250 Level

Given our assumption of no December taper and the fact that most of the recent rise in interest rates is due to an early-taper fear, we expect the 10-year yield to drop back to the 250 level.

The Dual Mandate Presents A Clear Dilemma For The Fed

The “dual mandate,” which means the Fed is paying close attention to both inflation and employment, presents a clear dilemma for the Fed when it comes time to decide on a taper.

10-Year: Year-End Target Still 250 BPS, Interim Volatility Expected

We don’t think the numbers between now and the Fed’s December meeting will be strong enough to convince it to start tapering this year. No taper until 2014, in our opinion.

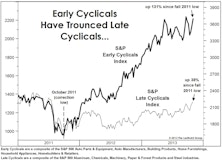

Cyclical Stocks: Is It Finally Getting “Late?”

There’s no reason to run for cover if the Early Cyclicals have topped out.

Data Dependency—September Taper Still Likely

More upside surprises are still likely and, despite the disappointing jobs report, the overall economic picture still supports a September taper. The improving economic picture is not just happening within the U.S., but in other major countries. We still believe the upside for the U.S. 10-year is limited.

10-Year: Taper the Taper—Upside Limited

If interest rates keep going higher from here, we would run the risk of derailing a still-fragile recovery. As long as the Fed tapering uncertainty exists, we expect higher volatility on the 10-year yield to persist in the mean time.