Telecommunication Services

Late March Reversal… And The First Shall Be Last

We examine the impact of March’s strong group leadership reversal on the top and bottom of our group model.

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

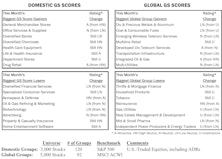

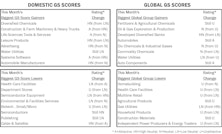

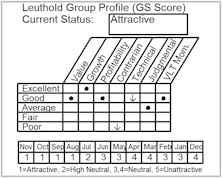

Group Models: Info Tech Tops Domestic, Financials Remain Atop Global

Both models have numerous Information Technology and Financials groups in Attractive territory. Neither model has any Unattractive Tech groups. Alternatively, neither model has any Attractive Utilities groups, while several Utilities rate Unattractive in each.

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

Sector Margins: Just Thank The Consumer

We’ve noted before that profit margin gains since the technology boom have been primarily a Large Cap phenomenon.

Key Observations On Q2 S&P 1500 Earnings

Year-over-year EPS growth rate for companies with Q2 reports (with about 65% in) currently stands at +4.2%, while revenue growth has come in at a better than expected +2.6%.

Group Models Agree On Energy & Materials

But Information Technology rises to the top of the Domestic model, while the trend of Financials domination in the Global model remains intact.

Domestic and Global Group Models: Strong Agreement On Financials

Our Domestic Scores have five Financials groups rating Attractive; these same five industry groups are Attractive in our Global model. In total, seven Financials groups rank Attractive in the Global model, with insurance groups looking particularly Attractive.

New Positions In Select Industries Portfolio

Two groups were purchased in the Select Industries portfolio in late October: Health Care Services and Wireless Telecommunication Services.

Tech Watch

Technology stocks soar again as our broad tech index gained 26.4% in November.

Calling On the “Phones”

We are activating “The Phones” this month and plan a 5% position for this concept within our Model Equity Portfolio. Our goal is to provide a very defensive concept with reasonable P/E ratios and relatively high dividend yields in big liquid phone companies.

View from the North Country

Back on January 1, 1984, American Telephone & Telegraph was broken up into the seven “Baby Bells” and AT&T. At the time, Wall Street was not impressed with the prospects. But the telephone “Break-Up” Portfolio was hard to beat 1984-1989.

“Ring Them Bells”

We are establishing the regional Bell companies as a formal equity portfolio sector, initially investing in BellSouth, NYNEX and U.S. West in this issue. We think these companies look like an attractive defensive equity haven these days.