Time Cycle

2021 Surprises & 2022 Time Cycles

Market revelations were certainly not in short supply in 2021. We believe some of those surprises will continue to have a huge impact on markets in 2022. We have updated our time-cycle composites to provide an idea of what a “typical” 2022 could look like.

2021 Time Cycle — A Year Of Two Halves

We’ve updated our time-cycle composite for 2021 and it looks like it will be a year of “two halves,” with a low-vol bull-market extension in the first half of the year, followed by a much more volatile second half. This also appears to extend outside the U.S.

2019 Time Cycle—Hope Springs Eternal

We are heading into a pre-election year that boasts one of the best time-cycle patterns. Most markets, Developed and Emerging, show good patterns for 2019, even with different election cycles.

2018 Time Cycle—Mid-Year Update

2018 has been very atypical so far. But if the historical pattern is any guide, a near-term pull back should be expected in most equity markets, followed by nice year-end rallies.

2018 Time Cycle—Beware A Fall Correction

The most common 2018 time-cycle pattern among major markets is a fall correction, with the U.S. and Japan faring better than their European counterparts.

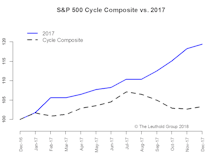

2017 Time Cycle—Mid-Year Update

Most risk markets have tracked their 2017 time cycle patterns well, but what really stands out is the risk of an autumn correction across all these markets. Caution is warranted going forward.

2017 Time Cycle—A Tale Of Two Halves

In 2016, both the U.S. and the U.K. stock markets tracked their historical patterns quite well but other international equity markets and non-equity markets tracked poorly.

Time Cycle Mid-Year Update: Going Off Script?

Divergences have emerged: countries on a tightening path (e.g. US and UK) were more or less on track until June; while countries on an easing path (e.g. Germany, Japan, & Australia) went off script, as policy trumped historical patterns.

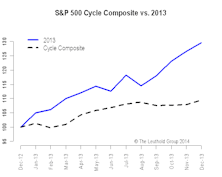

2015 Time Cycle—Giving The Bull The Benefit Of The Doubt?

We are again impressed by the pattern’s predictive ability as most equity markets tracked their respective patterns quite well in 2014. Another banner year seems to be in store for the S&P 500. The exceptionally favorable pre-election year is the main reason, but we cannot be too complacent.

Time Cycle Composite—Mid-Year Update

Our beginning-of-the-year message—“lower your expectations and be patient” has largely been true so far this year as most equity markets tracked the historical pattern pretty closely.

2014 Time Cycle—Lower Your Expectations & Be Patient

It’s time to update our time cycle composites, and what they say for equities in the U.S., U.K., Germany and Japan and long-term interest rates and credit spreads in the U.S.

Time Cycle Composite Mid-Year Update—More Volatility & Lower Returns in H2

For the first half of the year, QE tapering disrupted the usual patterns for most interest rate related markets but equities are largely on track. In the second half, the common message seems to be higher volatility and lower returns.

2012 Time Cycle—Mid Year Update

1st half LT rate movements tracked cycle composite well, but we differ on the pattern in the second half. The “muddle through” pattern on the U.S. Composite Leading Indicator is more consistent with our view.