Wages

Labor: Snatching Defeat From The Jaws Of Victory

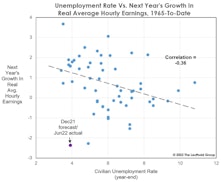

This year it’s been popular to say the Fed will hike interest rates until it “breaks something.” Has that not already happened? Pull up charts of the Japanese yen, the British pound, and the euro, among others. And stateside, the Fed has broken one of economists’ favorite toys: the Phillips Curve.

Lagging From Behind?

As Yogi Berra might have quipped, it’s not just the leading indicators that are lagging… the lagging ones are, too.

Labor Cost Observations

We take a look at different data sets reflecting labor costs. The main finding is that using Unit Labor Cost as the measurement for the true cost suggests that the labor market is very tight in terms of affordability for businesses.

Margins Prove Capitalism Still Works

Corporate profits were outstanding last year, but even the benefit of a 40% cut in the top income-tax rate wasn’t enough to lift the net profit margin back to the all-time high of 10.6% established in early 2012. Still, the latest 10.0% figure is more than a percentage point above the 2007 cycle high and about two points better than any other cycle high.

Interest Rates Range Bound—Can’t Be Too Bearish

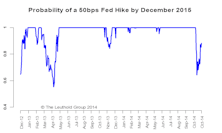

The sell-off in risky assets in early October promptly led to expectations of a more dovish Fed.

Second Half 2007: Inflation Acceleration Expected

CPI inflation accelerated again in March. As we see it, the important development is that inflation has broadened out.

Inflation Outlook: Worrisome

CPI and PPI monthly inflation kicked up a bit with February readings and could do so again when March results are released.

Inflation Still A Potential Threat

Inflation trends are a mixed bag at present.

Inflation Trends Are A Mixed Bag

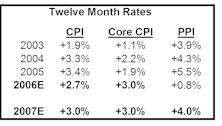

Twelve month rates of change for both CPI and PPI have been trending down over the past fifteen months, and seem to be less of an immediate threat. But, the Core CPI seems to be in an uptrend.

Inflation Is A Potential Threat

Inflation prospects are especially unclear. While many inflation gauges seem to be slowing, the threat of an inflation flare-up remains.

Inflation Still A Potential Threat

Looking ahead, CPI twelve month rate of inflation is likely to be in the +2% area for the first half of 2007.

Inflation Concerns

Inflation expectations seem to be on the rise.

Inflation Watch

CPI on a twelve month basis still expected to decelerate over the next three months. The final 3 months of the year, however could be another story, with CPI twelve month inflation accelerating.

Inflation Watch

Major reason for lower inflation forecasts is expectation of slowing economy (recession?) in 2006.

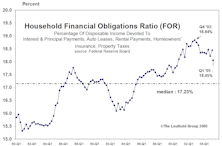

The Consumer: Still Chugging Along

Consumer spending may have finally peaked in this cycle, but a consumer collapse is far from imminent. Consumers can be expected to remain supportive of economic growth.

Inflation Watch

After a brief dip, project twelve month CPI to accelerate to about +3.8% by year end.

Inflation Watch

We continue to be more optimistic about the dollar than most, and believe the post election U.S. dollar weakness was overdone.

Inflation Watch: 2005 Outlook

Further U.S. dollar weakness could certainly be an inflation negative (higher import prices), but we are more optimistic about the dollar than most.

Inflation Watch: 2005 Outlook

For now the economic expansion remains healthy, but could fade some in the second half of the year.

2005 Outlook: High Energy Prices Will Show Up In Next CPI & PPI Reports

We estimate +3.3% real GDP growth in 2005, after weakening in the second half of the year.

View From The North Country

Steve Leuthold’s commentary on how he would structure a defensive portfolio.

Inflation Watch: 2005 Outlook

CPI and PPI declined more than expected in December due to impact of lower energy prices.

Looking Ahead To 2005

Continued U.S. dollar weakness could certainly be an inflation negative, but we are getting more optimistic about the dollar.

Recent Surge In CPI/PPI Inflation Temporary, Not Sustainable

Higher oil prices and higher food prices pushed recent CPI and PPI higher. Next month’s readings will likely show less inflation with oil prices coming down some recently.

View From The North Country

Per Ray DeVoe, pay increases for the service sector workers are running at a 7%-8% annual rate of increase, compare this to the BLS calculation of +3.5% for this same sector. Steve and Sharon ride the rails through the Scotland highlands.

View From The North Country

Workers’ stock market purchasing power at all time low. Also, a book out of the past, has an eerie ring to it.

View From The North Country

Despite proclamation of a “neutral” bias toward future interest rate shifts, expect the Fed to raise short rates at least 25 basis points more.

Bond Market Summary

Among the industrial nations, U.S. bond market offers highest yields, a reversal from earlier in the decade...A return to “normalcy” implies falling US bond yields.

Bond Market Summary

Bond risk still considered well below potential equity market risk...longer term, bond potential returns at least equal to potential equity returns.

View From the North Country

The balanced budget: politicians had to move fast because the budget looked as if it might balance itself without their help. Wage Inflation: our belief that it has been accelerating has been wrong, particularly in Q2.

Bond Market Summary

How long can the Goldilocks’ economy keep going? The current economic expansion (at 25 quarters) is long in the tooth by historical standards. Inflation outlook improved. Shortage of treasury bonds to become a reality?

View From the North Country

Current government wage inflation statistics don’t jibe with today’s real world. Future releases will show a significant jump.

Bond Market Summary

Economic expansion long in the tooth...Fed working to slow down the economy...Inflation cool...U.S. rates very competitive with foreign yields...strong dollar should continue to stimulate foreign bond buying.

Bond Market Summary

Bond rally should be rekindled by mid-year. U.S. yields remain relatively high compared to foreign yields. Bonds expected to outperform stocks over next 6-12 months.

Bond Market Summary

Bonds expected to outperform stocks over next 6-12 months...economy should slow, inflation should remain under control, and corporate earnings momentum should gradually fade.

Bond Market Summary

Bond market decline slowed in May. But positive economy news, potential Fed tightening (not likely near-term), and labor inflation still disturb bond market investors.

View From the North Country

The Economic Surprise And Inflation, The Feds Overheating Economy And Inflation Fears Are Justified and “Contract With America”: The Danger Is Big Tax Cuts But Minimal Spending Cuts

View From the North Country

Economic growth and stock market performance don’t go hand in hand - the stock market looks ahead. Don’t be surprised by more wage irrflation. The AdvantHedge short selling program is updated and explained because readers have expressed a growing interest (maybe it’s the market).

View from the North Country

A month ago, this section featured the commentary "Bad News For The PBGC (And The Taxpayer)". This proved to be quite timely.

View from the North Country

The Ross Perot Factor...A New Hero Streaks Across The Political Heavens... Let’s Screw the Kids (Government Generosity for the Elderly)...U. S. Cheap Labor?

.jpg?fit=fillmax&w=222&bg=FFFFFF)