Yield

The Yin And Yang Of Utilities

Are Utilities defensives, or are they interest rate plays, or both? We believe the driving influence fluctuates based on market conditions, specifically fear, and the desire for protection in down markets.

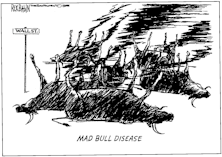

Muster Drill: To The Value Lifeboats

While we’re not calling for an imminent market top, we are keeping a diligent watch from the crow’s nest for signs of a coming market correction.

Four Divergences—A Steepening Correction

While we still believe flattening is the more likely scenario over the medium term, we do feel the recent flattening move is a bit overdone and there are several divergences that suggest a short-term steepening correction is in store.

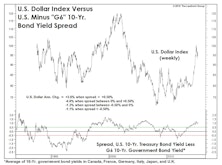

What’s Next For The Dollar?

The U.S. Dollar Index has recovered about half the losses from a two-month, -7% setback from the 12-year peak it established in March.

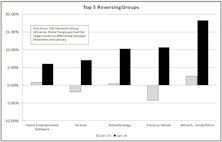

Discrepancies Arise Between December & January

January could be a month that disrupts the current trend, but one month is not enough time to merit a changing of the guard.

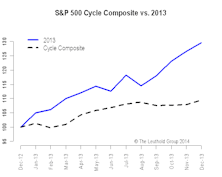

2014 Time Cycle—Lower Your Expectations & Be Patient

It’s time to update our time cycle composites, and what they say for equities in the U.S., U.K., Germany and Japan and long-term interest rates and credit spreads in the U.S.

10-Year Still Range Bound Between 185-245 But Expect Higher Volatility

We think the 10-year yield will likely consolidate around 200-215 before taking a shot at 245. The 245 level looks like a strong barrier and will likely hold in the foreseeable future.

Implications Of The End Of Negative Real Yield

The 10-year real yield turned positive at the end of 2012 and has stayed there. We expect higher interest rates, a stronger dollar, and lower gold prices in the next twelve months.

“Just Make It Go Away”

Jim Bianco observed in September that Europe was still in a “pre-Lehman” mentality regarding its debt crisis, in which investors and policymakers “were worried more about the equity and propriety of where taxpayer money was going than about fixing the problem.”

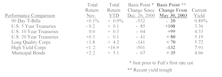

Economic Outlook

Falling interest rates and declining oil prices should bolster consumer spending and hopefully get us past the current economic soft spot.

Economic Outlook

GDP growth of 5.0% projected for 2004. But, fast growing U.S. budget deficit ($507 billion in 2004?) is a significant problem for bonds.

Economic Outlook

GDP growth of 5.0% projected for 2004. But, fast growing U.S. budget deficit ($483 billion in 2004?) is a significant problem for bonds.

Economic Outlook

Don’t get drawn into the TIPs trap. Lack of attractive bond opportunities and prospects for higher inflation may draw investors to Treasury Inflation Protected Bonds. However, there is still risk of significantly higher interest rates, and the fact the inflation factor is tied to an unreliable CPI.

Bond Market Summary

The spread between Long Quality Corporates and twenty year Treasury bonds is back down to a normal level, as the Treasury shortage elimination-thesis has fallen apart due to rising budget deficits.

Bond Market Summary

GDP growth of 5.0% projected for 2004 (6% in the first half, 4% in the second half). But, fast growing U.S. budget deficit ($475 billion in 2004?) is a significant problem for bonds.

Bond Market Summary

Fast growing U.S. budget deficit ($374 billion in 2003) is a significant problem for bonds. Project 2004 budget deficit will expand to $535 billion.

Bond Market Summary

GDP growth of 5.0% projected for 2004. But, fast growing U.S. budget deficit is a significant problem for bonds.

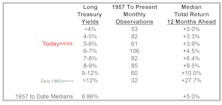

Below Average Returns Expected From Long Treasuries

New study by The Leuthold Group suggests below average Long T-bond returns can be expected from today’s below average Long T-bond yield of 5.19%.

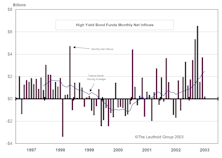

Below Average Returns May Be Expected When Junk Bond Yields Fall Below 9%

New study by The Leuthold Group suggests below average High Yield bond returns can be expected when Junk yields fall below 9%.

Bond Market Summary

Economy picking up steam in second half. Revised Q2 GDP better than expected.

Bond Market Summary

High Yield bonds rated marginally attractive after continued spread narrowing.

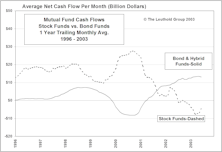

The Blind Stampede Into Bond Funds

Investor preference toward bond funds, chasing performance, may be left behind once again. Bonds not expected to generate very good returns from current levels based on historical analysis of returns.

Bond Market Summary

“Risk-free bond returns could become return-free risks.” The Leuthold Group has hedged its fixed income position by shorting U.S. Treasuries. May completely hedge entire fixed income exposure later this month.

Bond Market Summary

Is the Fed ready to buy Ten Year Treasuries to stimulate the economy? This could certainly lead to another housing/refi boom. But are lower rates really necessary to boost business spending?

Bond Market Summary

Is the Fed ready to buy Ten Year Treasuries, if necessary to stimulate the economy? This could certainly lead to another housing/refi boom, but will it be the catalyst to boost business spending/borrowing? We think not.

Bond Market Summary

New bond market timing tool discovered. Testing reveals it has a remarkable forecasting record. Currently signaling bond market top!

Bond Market Summary

The spread between Long Quality Corporates and twenty year Treasury bonds at the pinnacle is back down to a more normal range, as the Treasury shortage elimination-thesis has fallen apart due to rising budget deficits.

Bond Market Summary

We believe it is still an opportune time to add to High Yield positions. The economy is improving and corporate profits are rebounding from depressed levels.

Answering Client Questions

Many of the questions in this month’s issue came from November’s client meetings in San Francisco.

Bond Market Summary

Huge secular bull market in bonds (emerging in 1981) is topping out.

Bond Market Summary

Expect CPI and PPI to both edge higher in second half of year...could be negative surprise, but not something big.

Bond Market Summary

Expect CPI and PPI to both edge higher in second half of year...could be negative surprise, but not the start of something big.

Bond Market Summary

Near term, bond market may continue to rally as economic reports have become more mixed (less bullish). But long term secular bull market in bonds emerging in 1981 has probably topped out.

Bond Market Summary

Expect rally from current oversold conditions, but overall, we think secular Bull Market in Bonds is topping out.

Bond Market Summary

Rally due in Q1 2002, but we think Bull Market in Bonds is topping out.

Bond Market Summary

Rally due in Q1 2002, but we think Bull Market in Bonds is topping out.

Bond Market Summary

Bond Market weakness is adjustment to end of Fed easing cycle.

Bond Market Summary

Bond market adjusting to end of Fed easing cycle, expected 2002 economic recovery and corporate rush to lock in lower borrowing costs.

Bond Market Summary

Expect further Fed cuts in short rates, but this could do more harm than good.

Bond Market Summary

Yield curve has risen dramatically in recent weeks, probably forecasting economic recovery ahead (6-12 months?), but also reflecting deteriorating budget surplus situation.

.jpg?fit=fillmax&w=222&bg=FFFFFF)