2-Year Treasurys

The Terrible “Two-Year”

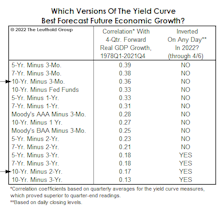

In a simple test of 15 yield-curve variants, we found that the 2s10s spread ranks second to last, based on its correlation with one-year-forward real-GDP growth since 1978. The three best measures employed the 3-month bill as the “short” rate. The spread between the 5-year note and 3-month bill showed the strongest correlation with subsequent economic growth.

The Market Is Off Its Meds!

Well before the war drums in Eastern Europe began to beat, this stock market correction had already been marching to a different beat. The market’s confusion might be understandable, because—unlike during most of the post-GFC corrections—it has so far failed to “self-medicate!”

A persistent feature of stock market declines in the past 13 years has been that they have typically triggered a simultaneous falloff in bond yields.

.jpg?fit=fillmax&w=222&bg=FFFFFF)