AdvantHedge

These “Insiders” Have Exited; Should You?

What if the S&P 500’s September 2nd closing high were to miraculously stand as the cycle’s high-water mark? If it did, the peak was presaged—in retrospect—by two Federal Reserve Bank presidents who rode the liquidity wave all the way to its crest after assuring the floodgates would be left wide open. Both resigned in September.

100% Short Portfolio: AdvantHedge

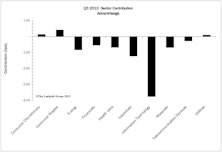

AdvantHedge trails S&P 500 inverse YTD; largest sector weights are Info Tech, Industrials, Energy

100% Short Portfolios

Info Tech and Consumer Discretionary are largest sector weights in domestic portfolio.

100% Short Portfolios

Our AdvantHedge gross composite lost 0.8% in November, outpacing the inverse performance of the S&P 500 (+2.7%) and the NASDAQ (+3.7%), but not the volatile Russell 2000 (+0.1%).

100% Short Portfolios

Consumer Discretionary is heaviest weight in domestic and Global AdvantHedge.

100% Short Portfolios: Both Domestic And Global AdvantHedge Outpaced Benchmarks For Month & YTD

Info Tech is largest sector weight in domestic AdvantHedge; Consumer Discretionary is heaviest weight in Global AdvantHedge.

100% Short Portfolios: Both Domestic And Global AdvantHedge Trailed In June And Lag YTD

Info Tech is largest sector weight in domestic AdvantHedge; Consumer Discretionary is heaviest sector weight in Global AdvantHedge.

100% Short Portfolios: Domestic Version, AdvantHedge, Beat Benchmark In May

YTD Performance: AdvantHedge -4.4%; Global AdvantHedge -3.9%

100% Short Portfolios Beat Benchmarks

Global AdvantHedge up 1.67% in April; AdvantHedge -0.01%

Short Portfolios: Both Portfolios Lag Benchmarks

Both of our short strategies have failed to keep pace with the inverse of their respective benchmarks so far this year.

Short Portfolios: Both Portfolios Up For The Month But Lag Benchmarks

Both of our short strategies failed to keep pace with the inverse of their respective benchmarks this month.

Short Portfolios: Both Portfolios Up For The Month But Lag Benchmarks

Considering the market’s weakness in January, we are a little disappointed with the performance of our short portfolios.

Short Portfolios: Both Portfolios Outperform Benchmarks

Considering the market’s strength, we are pleased with the performance of our short portfolios.

Short Portfolios: Both Portfolios Outperform Benchmarks

Considering the market’s strength, we are pleased with the performance of our short portfolios.

Short Portfolios: AdvantHedge Sees Strong Performance

Considering the market’s strength, we are pleased with the performance of our short portfolios.

The Short Side - Hangs On In September

Our AdvantHedge composite lost 2.6% in September, outperforming the inverse performance of the S&P 500 (+3.0%), the Russell 2000 (+6.4%), and the NASDAQ (+5.1%).

The Short Side - AdvantHedge Lags YTD

Our AdvantHedge composite gained 0.8% in August, lagging the inverse performance of the S&P 500 (-2.9%) and the Russell 2000 (-3.2%) while matching that of the NASDAQ (-0.8%).

The Short Side—Still Ahead YTD

Our AdvantHedge Composite lost 5.9% in July, lagging the inverse performance of the S&P 500 (5.1%), but outpacing both the NASDAQ (6.6%) and the Russell 2000 (7.0%) as the market returned to “risk-on” mode.

The Short Side - Slightly Ahead YTD

Info Tech remains the largest sector short position, while Energy is second.

The Short Side — Slightly Ahead YTD

Info Tech remains the largest sector short position, while Energy is second.

Short Selling: From Un-American To All-American

It doesn’t seem too long ago when short sellers were vilified for bringing down viable public companies, and the appropriate punishment for short selling was deemed to be a public caning.

Did You Have The Right Mix In 2005?

2005 Performance Recap: Equities, Fixed Income, Large Vs. Small Caps, Weighted Vs. Unweighted S&P 500, Industrial Metals and AdvantHedge.

AdvantHedge

Not a hedge fund, but a disciplined quantitative program that is always 100% short.

View From the North Country

Economic growth and stock market performance don’t go hand in hand - the stock market looks ahead. Don’t be surprised by more wage irrflation. The AdvantHedge short selling program is updated and explained because readers have expressed a growing interest (maybe it’s the market).

A New Risk Control Program: AdvantHedge

In 1988, Leuthold first presented his partners at Weeden and Company with the idea of a defensive short selling program designed for large pools of capital, employing only highly liquid large cap stocks selected on a highly disciplined quantitative basis.