Annual Returns

Research Preview: Returns In A Year Of Dollar Strength

The U.S. Dollar Index (DXY) has gained 16.2% YTD, its best performance in almost 40 years. However, a strong dollar is bad for those with international investments, as returns are slashed when translated back into dollars.

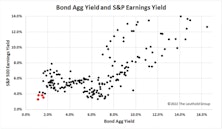

The 60/40’s Annus Horribilis

The balanced portfolio strategy of allocating 60% to equities and 40% to fixed income generated a highly satisfactory 7.9% annualized return over the last 30 years. Despite the excellent returns earned by investors following this strategic model, the past couple of years have seen a parade of articles with headlines such as “Is the 60/40 Portfolio Obsolete?” and “Is the 60/40 Dead?” Given the central importance of this moderate allocation strategy to investment industry practices, we felt a closer look at the 60/40 portfolio was in order.

Supercharging VLT With Small Caps

Leuthold did not invent VLT. The credit goes to Sedge Coppock, a technical analyst who insisted on being called an “econometrician.” While the famed Coppock Curve was based on the Dow Jones Industrial Average, Leuthold found the algorithm useful at the industry group level—it is a component within our Group Selection (GS) Scoring system.

Rewarding “Perfect Foresight”

Remember, the All Asset No Authority Portfolio assumes complete naïveté on the part of the portfolio manager. That’s one extreme of the asset allocation continuum—although few allocators would admit that such an approach might be viable, despite its respectable history.

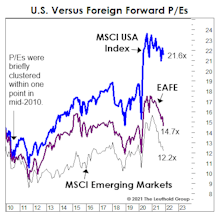

Our Annual Lament On Foreign Equities

There should be a name for the syndrome suffered by foreign stock investors over the last decade or so. “Groundhog Day” doesn’t quite cut it, because that event repeats only once a year. It seems like this time of year we always feature a chart showing a healthy YTD double-digit gain in the S&P 500, along with a bond-like gain in EAFE, and a bond-like gain or loss in the MSCI Emerging Markets Index.