Attitudinal

Sentimental Musings

We get irked when TV pundits misrepresent the mood of equity investors as unduly pessimistic based one or two (or zero) data points. Among the dozens of “Attitudinal” indicators we track, an overwhelming majority show professional and retail investors have jumped back into the fray.

Here’s One Reason Sentiment Is So Subdued...

Market bulls remain mystified by the lack of enthusiasm for stocks given the proximity of U.S. indexes to all-time highs. They view this relative indifference as a contrarian positive—the “wall of worry” argument.

Odds & Ends

Here are some brief follow-up notes on topics covered in recent months’ Green Books.

Leuthold Quick Takes: Getting Sentimental

This issue of Leuthold Quick Takes reviews the conflicted nature of investor sentiment as seen by Doug Ramsey (Chief Investment Officer) and Jim Paulsen (Chief Investment Strategist).

Stock Market Observations

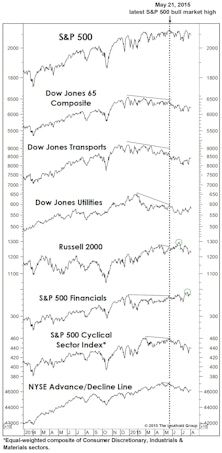

Throughout the spring and summer, the market could alternatively be characterized as “divergent” or “disjointed”—but until very recently it could not be considered “distributive.” Now, Mid and Small Caps have hit a short-term air pocket and breadth figures were exceptionally poor at September’s scattered highs in the DJIA and S&P 500.

Change In Market Character

The Major Trend Index fell into its negative zone last week and we trimmed the already below-average net equity exposure in tactical accounts by a few more points, to a current 41-42%.

Thoughts On Sentiment

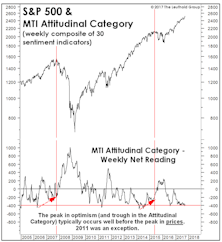

The MTI’s Attitudinal category has held stable over the last several months, an impressive (and contrarily bullish) feat considering the steady onslaught of new bull market highs.

Plenty Of Love For The Rally

The less-well-known Stock Market Confidence survey from the Conference Board has poked into “excessively optimistic” territory for the first time since 2003

Safety In Numbers?

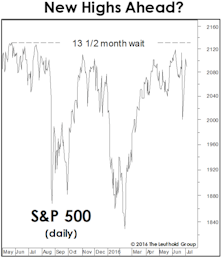

The S&P 500 closed the first week of January at a new cycle high, up 9.2% from the pre-election low made on November 4th.

“Changes In Attitudes, Changes In Latitudes”

The above caption—and Jimmy Buffett song title—comes from the “View From The North Country” section in the first-ever Green Book published in November 1981. Not much has changed in 35 years.

Stock Market Observations

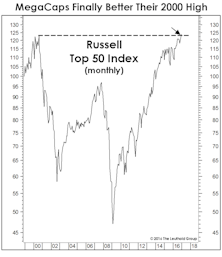

With the S&P 500 levitating near its all-time high, stock market leadership is peculiar—characterized by a flight to quality. And, despite the market’s violent bounce off February lows, there have been only four new market highs set by key indexes on our “Bull Market Top Timeline” table.

Overthinking Market Sentiment

This month’s “Of Special Interest” allots eight pages to the (opposition) view that the correction is over, featuring charts we find the most threatening to our bearish stance. Based on its sudden popularity among the press and punditry, the indicator in this chart—highlighting the air-pocket in investor confidence—perhaps should have been part of that feature. Here’s why it wasn’t.

The Bullish Case: A Mental Exercise

We’ve been correctly positioned near our tactical portfolios’ equity minimums, yet we’re oddly compelled to use this month’s “Of Special Interest” section as a very public second-guessing of that move.

Expect A "Round Trip" In Sentiment

When the “most hated bull market on record” finally suffers a steep decline, it’s reasonable to expect that the hatred might evolve into true revulsion.

Stock Market Observations

The U.S. stock market has largely shrugged off the latest round of worries related to China’s stock market collapse, the new down-leg in crude oil, a more hawkish tone in Fed-speak, and sizable second-quarter declines in S&P 500 sales and earnings.

Beware The New ‘Wall Of Worry’

The Volume Oscillator discussed in this section is one of several encouraging developments within our Attitudinal work that has sent that category to its least negative reading (-57, Chart 1) since July 2013.

Margin Debt: Much Ado About Not Very Much

Margin debt levels are high, but that’s because stock prices are high. The critical relationship is the comparative rates-of-change in Margin Debt and stock prices.

Time For A Spring Shower?

The stock market staged a two-day bearish reversal beginning a few hours after the release of the March employment report, a decline that could —based on the bearish status of a single MTI category (Attitudinal)—carry further before it is finished. But with the S&P 500 (and many other U.S. equity indexes) recording a bull market high as recently as April 2, it’s too early to argue the market top is “in.”

Stock Market Observations

With our equity exposure high and our disciplines still tilting bullish, we’re naturally more concerned with what might go wrong than missing out on some kind of 2013 repeat.

Major Trend Moves To Neutral, But Not All Hope For The Bulls Is Lost

Deteriorating Technicals drove the move to Neutral, but a new positive reading in the Attitudinal category gives some hope to the bulls.

Everyone's A Contrarian!

The analysis of stock market sentiment is an area that’s become especially prone to selective perception, what with the explosion in creative, New-Economy ways to measure investor mood (Twitter activity, Google searches on key phrases, etc.). By the sheer law of large numbers, a market commentator with any view whatsoever can now ferret out enough data points or market anecdotes to paint him/herself as a maligned and misunderstood contrarian.

Major Trend Index Fading As “That Time Of Year” Looms

With “That Time Of Year” approaching and the Major Trend Index not too far above the neutral zone, we review nine factors impacting the stock market from a glass-half-empty perspective.

Sentiment And “Seasonals” Collide

Stock market sentiment is overheated, at least on a short-term basis. But does excessively optimistic market sentiment lead to worse September-October market action? Yes it does, but the observations are limited.

Was It “Easy Money” All Along?

The “easy money”—at least psychologically— may still be ahead for some. Money continues to move out of U.S. equity mutual funds, and there is still skepticism about the stock market.

Be A Buyer In An October Scare

Following a strong September, October may be a little weaker. However, readers should use any October scare to buy equities in anticipation of strong end to 2009.

Attitudinal Scores Among Highest Ever Recorded

Attitudinal category now very positive reflecting excess bearishness which typically comes near market bottoms.

Sentiment: Still Plenty of Non-Believers

Our Attitudinal analysis—or investor sentiment—normally deteriorates badly leading into a major market top, but has held up surprisingly well in the face of the last several weeks’ almost relentless, daily upside action.

What Does Market Sentiment Look Like?

The month’s “Of Special Interest” examines Attitudinal portion of the Major Trend to assess whether the market hit an important bottom during May to June market decline.

Market Sentiment: Currently A Mixed Bag

An in depth discussion of market sentiment...At present, it is a real mixed bag, there is no clear cut consensus.

This Was No Summer Of Love

In August, the bloodletting finally slowed: Majority of indices actually managed to eke out small gains.

Public Conficence Measures

Numerous measures experienced sharp drops corresponding closely to the stock market sell off. Without a bounce in the next two months, the outlook for the economy and the stock market may look quite bleak.

On the Borderline

Major Trend close to reverting to negative status with ratio at 0.95. Shades of 1968, that great speculative garbage market. 1996 is looking like a replay...it’s just like old times...greed, excitement, performance chasing, and no earnings IPO’s.

Investor Attitudes: Polling the Pros in Boston

What a difference a city makes (or a month, or 150 miles). Boston is much more positive about the stock market than New York according to last's month poll. Over a 1 year time horizon, we went from 6% "Bullish'' in New York to 33% "Bullish" in Boston.

Investor Psychology Measured by P/E Momentum

In 1988, corporate profits have been surging ahead, but the stock market has paid little heed. Investor psychology is still negative. Good earnings reports are greeted with a sell off more often than a rally.

.jpg?fit=fillmax&w=222&bg=FFFFFF)