Automotive Retail

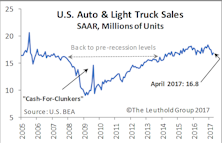

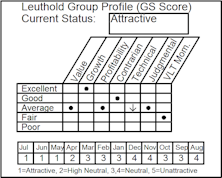

Automotive Retail: Attractive Amidst Industry Recovery

Automotive Retail currently ranks Attractive per our Group Selection Scores. This group offers a range of exposure to a bumpy—but recovering—U.S.-auto industry made up of car dealerships and auto parts & service retailers.

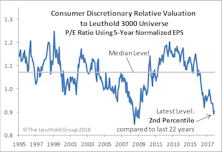

Consumer Discretionary Back On Top

Of the 110 industries in our framework, the top seven are all Consumer Discretionary.

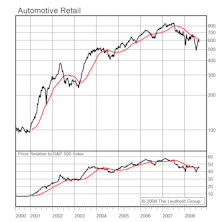

Dynamics Shift Among Auto-Related Industries

Automotive Retail group takes a backseat while Auto Parts & Equipment takes over the wheel. We examine the market/environmental dynamics that may be causing these groups’ routes to diverge.

Highlighted Attractive Groups

Automotive Retail improved into the top five rankings; Biotechnology, despite being out of favor, has both long-term growth potential and higher profitability than Pharmaceuticals; Developed Diversified Banks is up almost 20% since the election.

Highlighted Attractive Groups

Airlines, Asset Management & Custody Banks, and Automotive Retail all have attractive Valuations and strong VLT Momentum.

Highlighted Attractive Groups

Highlighting Automotive Retail, Education Services and Insurance Brokers.

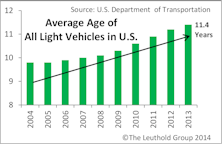

Automotive Retail: Still In The Driver’s Seat

We revisit this long-held industry group and explain our positive outlook going forward.

GS Score Sector Rankings, and Highlighted Attractive Groups

Health Care, Info Tech, and Consumer Discretionary are the top three rated broad sectors.

Can Consumer Discretionary Relative Strength Continue?

Despite this sector’s extended outperformance, we think this trend may persist in the near term as Discretionary industry groups look increasingly attractive within our group work. Keeping an eye on the Fed Funds rate is key, however.

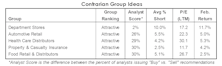

Our Most Contrarian Group Ideas

Using “Analyst Score” to measure sentiment and our Group Selection (GS) Scores, we present what appear to be the most quantitatively Attractive, yet disliked equity groups.

Retail Groups Rise In The Ranks

A new theme emerging within our GS Scores—Retail related industry groups are flocking to the upper rankings of the scores.

Automotive Retail Shines In A Dimming Sector

We examine the highly ranked Automotive Retail group and explain why, despite its recent strength, it may still have room to run.

Highlighted Attractive Groups

A quick look at the Commodity Chemicals, Automotive Retail, Aerospace & Defense, and Computer & Office Hardware groups, all of which caught our eyes this month.

Long Only Portfolios Finish 2013 Strong

Select Industries deactivated Specialized Finance. Global Industries deactivated Food & Staples Retail and Road & Rail and purchased Managed Health Care.

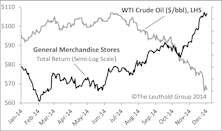

Broad Themes Found In Auto & Insurance Industries

We like when we can find groups inside of broad themes, and these two industries are amongst the strongest in our work right now.

Select Industries: Minimal Turnover

There was little turnover in the GS Scores this month and no group deactivations. With minimal capital to work with, we added selectively to existing group holdings.

Checking In On Some Past Group Ideas

Updates for three groups we highlighted recently, including two domestic (Education Services and Automotive Retail), and one foreign-based thematic group, the Asia Healthy Tigers Index.

Automotive Retail: Attractive, But Fundamental Divergence

Automotive Retail Group rated Attractive, but consider the fundamental divergence between the two subsets of stocks included. Expect Auto Parts/Service Providers to remain strong; with Auto Dealers outlook less favorable.

Automotive Retail...Initiating A New 7% Portfolio Position

Adding a new equity group holding in Automotive Retail. This gives us about a market weight in the Consumer Discretionary sector, our most significant exposure in several years.