Bear Market Low

Pause, Or Paws?

The one-year anniversary of the 2022 bear-market low occurs on October 12th, yet—after all this time—we’re not confident enough to declare it as the bull’s first birthday.

We’re interested to see whether or not CBNC breaks out new baseball caps for the occasion, as they did in the late 1990s for “Dow 10,000.”

Checking In On The Rally At The Six-Month Point

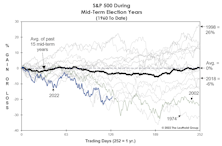

Yesterday was the six-month anniversary of the bear market low of 3,577.03 in the S&P 500. We think it’s unlikely the moderate upswing since then represents a new cyclical bull market. However, with the evidence still weighing in at Neutral, we’re not betting the farm on that opinion.

Normalizing The Abnormal?

In recent years, we’ve supplemented our longstanding normalized earnings technique with the simpler method of referencing any past peak in EPS (or, for that matter, trailing peaks in other corporate fundamentals, like cash flow and sales per share).

Time Cycles Got It Right; What Do They Say Now?

The enormity of the preceding mania and its vicious unwind have us believing the current bear could unfold over a much lengthier time than is typical. But a combo of time cycles suggests a major low is due any time.

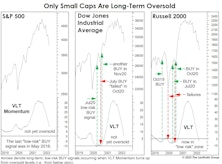

Down—But Not Washed Out

Based on a short-term perspective, stocks may be ripe for a bounce. However, the S&P 500 has not reached “oversold” territory since early 2016, and it is still a long way from doing so. Of the major indexes, only the Russell 2000 is now positioning to soon claim a “low-risk buy” signal.

Industry Group Dreams & Nightmares—The Bear Market Edition

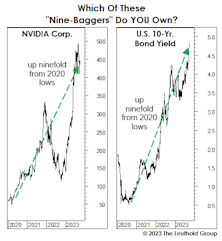

Given that we've recently passed the one-year anniversary of the bear-market bottom of March 2020, we thought it might be interesting to apply our annual Dream/Nightmare exercise to periods following bear-market lows; the idea here being that a major market bottom may serve as a “reset” for new industry trends.

A Bear That Left VLT Unscathed?

Our VLT Momentum algorithm was driven into oversold territory for at least a few months in all prior postwar bears. It didn’t happen yet this spring, which implies that the “grieving process” was neither deep enough nor long-lasting enough to set the stage for anything like a repeat of last decade’s bull. Most of our valuation work says exactly the same thing.

How Sharp Is This Falling Knife?

While it’s possible that Monday’s S&P 500 low of 2,386 will represent an important trading low, we believe it is too early to expect the market to form a major bear market low.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)