Long T-Bonds

Research Preview: Going Long

One of this year’s most fascinating stories in financial markets evolves around investors’ atypical response to the dreadful returns posted by TLT (iShares 20+ year Treasury bond ETF). Despite its dismal performance, investors have been moving a tremendous amount of money into TLT.

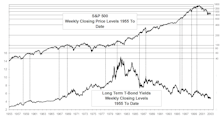

Rising Interest Rates Don't Prohibit Rising Stock Prices

This month, we provide historical evidence that stocks can indeed move higher, even when interest rates rise. Six periods since 1955 are proof that it can happen and we expect it to happen again.

Inside the Bond Market

T-bond achieves Leuthold long term target of 5%: hedge fund turmoil and Asia induced flight to quality has helped drive rates down too far, too fast. When some of the short term distortion subsides, yields could pop back up.

Inflation Update

Wage pressure is only cloud on inflation horizon.

Welcome to 1998

The new year has started with a disappointing thud rather than the liquidity induced bang expected by the consensus.

Inflation Update

Wage inflation looked like it was finally taking off in October, but November's data showed a different picture, as four of the nine subsets (including Total Wage inflation) moved lower.

Bond Market Summary

My current view towards long bonds from an institutional investor's point of view is to sell some now and sell some more when longer term momentum slows.

Bond Market Summary

Overall, July was one heck of a month for the fixed income markets. Most of the move in short term paper came early in the month but longer term fixed income securities continued their steady rise until the last three days of July.

Interest Rates: Historical Perspective

Today, T-bills are yielding 3.20% and high quality commercial paper is yielding 3.40%. It may be useful to examine these rates in a historical perspective. Some may think these are just about the lowest short term rates in U.S. history. Well, not quite.

The Bulls Also Have Christmas In The Bond Market

In November, long and short rates did not move together, but in December they sure did.

Bond Market Summary

The long bond market edged to a marginal new high in mid-November but sagged in the last half of the month. On the other hand, short rates fell sharply. Once again it has been demonstrated that long and short rates do not have to move together.

Bond Market Summary

Even though higher quality long bonds stalled in October, short rates continued to decline in anticipation of yet another cut in the discount rate. Once again it has been demonstrated that long and short rates do not have to move together.

Bond Market Summary

August was a good month for bonds. Long treasuries recorded net gains of three points or more, with yields falling 30 basis points. T-bonds are now back up to where we sold them in January and February 1991.

Bond Market Summary

In mid-April, the bond market broke sharply, stabilizing late in the month. The decline brought T-bonds down into the upper ranges of our buying zone (9%-10%). But in the first days of May they have rallied to 8.90%.

Bond Market Summary

For quite some time this publication has had a pretty good feel for the bond market. But May surprised me. My expectation was a stronger market early in the May followed by a correction.

Short Bonds vs. Long Bonds: Gain and Loss Potential

For several years now, this publication’s focus has been on long 20-year bonds, while many clients owning bonds maintain average 6-7 year maturities. Herein, we compare future performance of long and short bonds over several time horizons in a variety of projected interest rate environments, including projected parity levels for the stock market.

View from the North Country

Back to the Basics? We think individual stock analysis is becoming increasingly important… Tax Simplification Coming Soon: The 1984 additions to the tax laws (over 1300 pages) may be the last straw… A Potential Shortage in Treasury Bonds: I know this sounds absurd. However, in the upcoming financing, the Treasury is for the first time offering a 20-year bond that is callable in five years.

View from the North Country

The clock is ticking down, but we don’t know when the upside explosion will take place. It might even occur before the 1984 elections. Whatever, the investment rewards will be rich indeed. Should investors really run the risk of being out of the bond market? Really, the downside risk, considering the earning power of the coupons, is probably negligible. But the potential rewards are mouthwatering.

Bond Market Summary

The bond market has backed off this last month and there is a remote chance it might even retest the lows. But it looks to me like the lows have already been made and the cyclical bond bull market is back on the track.

Bond Market Summary

The bond market is in the midst of both secular and cyclical bull moves. The cyclical bull market target zone is 9% yields for T-Bonds in the next 12-18 months. Maybe much lower on a secular basis. The recent correction carried to our 12% T-Bond buying zone and we loaded up again.

Bond Market Summary

The bond market is in the midst of both secular and cyclical bull moves. The cyclical bull market target zone is 9% yields for T-Bonds in the next 12-18 months, maybe much lower on a secular basis. The current correction has carried to our buying zone and we are continuing last month’s new buy program in long T-Bonds.

View from the North Country

Merrill Lynch was first but the rush is on, stripping existing T-Bonds of their coupons, repackaging and selling coupons and principal separately. While perhaps priced too high for sharp pencil pushers, to us they look like a very good investment. Corporate “zeros” should, however, be viewed very cautiously.

Are Bonds Too Popular Now?

Dedicated portfolios, TIGR types, long-term bond buy and holders and bond traders soaking up the government financing like so many sponges. For long-term T-Bonds at least, the demand may be greater than the supply for a while, creating a premium situation. It’s hard to believe a T-Bond could become an investment rarity, but these are strange times.