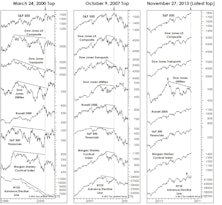

Bellwethers

A Failure of "Free Money"

Senator Rand Paul’s annual “Festivus” report on wasteful spending makes for sobering reading to the dwindling few who care about federal finances. The “low light” for 2021 was a $465,000 grant to the National Institute of Health for a study of pigeons playing slot machines.

No Bark, No Bite?

If NBER is correct that a new economic expansion began in mid-2020, then this cycle is unfolding in “dog years.” After limiting between-meal snacks earlier this year, champion-breeder Jay Powell has informed his pack of canines that their portions will also be reduced as of later this month.

Reading The Short-Term Tea Leaves

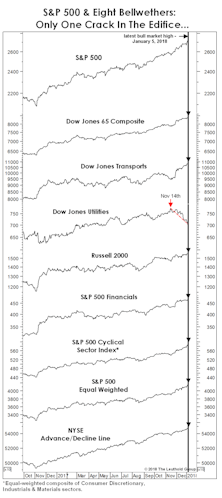

The market’s August push was enough to lift four of the seven lagging bellwethers to new cycle highs. Among the three remaining laggards, only the Dow Jones Transports is still significantly below its high.

Flesh Wounds, Or Something Deeper?

At the August 5th, S&P 500 bull-market high, seven of our eight bellwethers had failed to make a “confirming” high during the prior month of trading—up from six non-confirmations a month ago. “The dog that didn’t bark” (yet) is the S&P 500 Equal Weighted Index.

The Short-Term Tea Leaves: Suddenly Wilting?

The “Nothin’ Matters” market lifted the S&P 500 to eight all-time highs in the nine trading days through July 7th. It’s been difficult to assail the stock market’s technical merits, but there are suddenly some short-term cracks among the handful of market indexes we consider “bellwethers.”

Music For The “Mania”

At some point during the June/July streak of seven-consecutive S&P 500 daily-closing highs, an album from 1980 popped into our heads: Nothin’ Matters And What If It Did—released when John Mellencamp was still known as John Cougar. It brought to mind some “nothin’s” that seem not to matter.

Everything’s Great, And Everyone Knows It

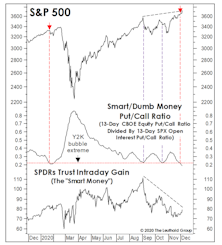

The “Biden Bump” brushed away any lingering technical deficiencies in the stock market, but that happy state of affairs is reflected in extremely frothy-looking short-term sentiment indictors. We are riding the momentum to some extent, but with a lower base-level of exposure.

Stock Market Observations

Throughout the spring and summer, the market could alternatively be characterized as “divergent” or “disjointed”—but until very recently it could not be considered “distributive.” Now, Mid and Small Caps have hit a short-term air pocket and breadth figures were exceptionally poor at September’s scattered highs in the DJIA and S&P 500.

“Don’t Just Do Something, Stand There!”

Inaction has been a richly rewarded trait throughout the current bull market, and especially in 2017.

“Top In” Or “Topping Out?”

The stock market rally has carried far enough to flip some of our trend-following work bullish, lifting the Major Trend Index to a low-neutral reading. The improvement prompted an increase in asset allocation portfolios’ net equity exposure to 42% (up from 36% previously).

No Time For The Hamptons

We’ve lived through many other low-volatility market rallies, but until the last couple of months we hadn’t experienced one in which clients, colleagues, and commentators were complaining so loudly of boredom.

A Quick Technical Take

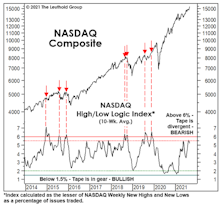

If a bear market is imminent, it will unfold with less “internal” forewarning than any cyclical decline since the late 1930s.