Biotechnology

Robust Health Care Leads Since Market Peak

Health Care has been the best performing sector following mid-February’s market peak. Its robust relative performance during this bear market isn’t terribly surprising given the sector’s defensive qualities, but it has impressively outpaced other safe haven areas.

Group Ideas For Tumultuous Times

The economic outlook has turned increasingly cautionary, investors are on edge, and the search for yield persists. Because the typical defensive/high-yielding plays are generally both expensive and unappealing in our group work, we highlight several less conventional groups that may be poised to outperform.

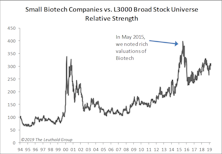

Small Cap Biotech Getting Pricey Again

In May 2015, we warned about rich valuations for small cap Biotech stocks and looked at various ways to evaluate those companies, as the majority have no approved drugs on the market, thus no revenue; therefore, valuing these companies using the conventional methodology is problematic.

Oil & Gas Drilling is Underwater This Week

Biotechnology and Precious Metals are this week's best groups. Oil & Gas Exploration & Prod. and Oil & Gas Drilling are this week's worst groups.

Metal and Glass Containers Get Shattered

Biotechnology and Alternative Carriers are this week's best groups. Regional Banks and Metal & Glass Containers are this week's worst groups.

Biotech Engineers a Good Week

Biotech and Small Biotech lead this week while Regional Banks and Hypermarkets & Super Centers lag.

Highlighted Attractive Groups

Automotive Retail improved into the top five rankings; Biotechnology, despite being out of favor, has both long-term growth potential and higher profitability than Pharmaceuticals; Developed Diversified Banks is up almost 20% since the election.

Biotechnology Leads This Week

Biotechnology and Biotech...Small/Micro were this week's best groups. Tobacco and Precious Metals were this week's worst groups.

Biotech Leads This Week

Pharmaceuticals and Biotech...Small/Micro were this week's best groups. Real Estate Investment Trusts and Department Stores were this week's worst groups.

Biotechnology Grows Stronger This Week

Biotechnology and Biotech...Small/Micro take the lead this week. Diversified Banks and Department Stores were this week's worst groups.

Biotechnology Leads This Week

Biotechnology and Health Care Facilities are this week's best groups. Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's worst groups.

Biotechnology Leads This Week

Biotechnology and Diversified Chemicals were this week's best groups and Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's worst groups.

Highlighted Attractive Groups

A snapshot of Automotive Parts & Equipment, Large Cap Biotechnology, and Reinsurance.

Biotechnology Leads This Week

Biotechnology and Health Care Services were this week's best groups and Electric Utilities and Coal & Consumable Fuels were this week's worst groups.

Biotechnology Leads This Week

Biotechnology...Small/Micro was this week’s best group and Independent Power Producers & Energy Traders was this week's worst group.

Biotech Flying High

Biotech (all sizes) had a huge week adding to impressive YTD results.

Biotech & Managed Health Care Continue Strong Year,

Biotech & Managed Health Care continue strong year, Coal & Consumable Fuels struggle.

Health Care & Consumer Sector Strength Explored

While we view the industry group selection as the most important decision, looking at the sector level rankings also helps us identify broad trends. Here we highlight the top two rated sectors, currently, which also represent a combined >40% weight in our Select Industries Portfolio.

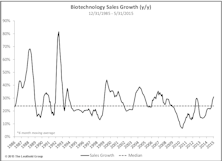

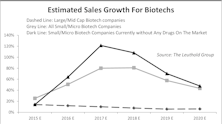

Small Cap Biotech Valuations: Proceed With Caution

While Large/Mid Cap Biotechnology companies are boasting rising profitability, better cash flows, and stronger drug pipelines, the Small/Micro Cap Biotech firms, in general, have little tangible to show and valuations may be above the comfort zone.

Group Selection Scores Off To A Great Start In 2015

Most of the factor trends that were in place at the end of 2014 have continued in 2015 thus far.

Biotechnology Now Attractive; Purchased In Select Industries

This group offers low correlation, some defensive qualities, and a dose of volatility. Health Care is now the top rated broad sector and we are overweight this sector in Select Industries Portfolio.

Internet Retail Claws Some Back

Internet Retail and Biotech lead the latest week while Home Entertainment Software and Live and Health Insurance lagged.

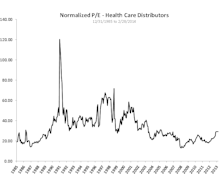

Health Care Strength... More Than Biotech?

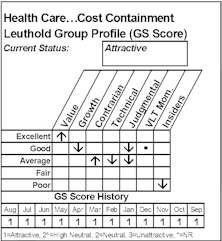

Three groups currently rank Attractive in the GS Scores: Health Care Distributors, Managed Health Care, and Health Care Equipment.

Biotech Off To An Explosive Start

| Best Performing Industry Groups | |||

|---|---|---|---|

| Industry Group | 1 Wk Perf |

4 Wk Perf |

YTD Perf |

| Biotech...Small/Micro | 8.5% | 28.2% | 23.8% |

| Precious Metals | 7.1% | 11.8% | 7.2% |

| Biotechnology | 6.2% | 13.9% | 10.1% |

| Diversified Metals & Mining | 5.9% | 6.2% | 0.0% |

| Computer Storage & Peripherals | |||

Biotechnology - New Portfolio Holding

Select Industries Equity Portfolio established new holding in Biotech, which boosted Health Care exposure in that portfolio to over 45% of assets.

New Group Position — Adding Biotechnology

Adding Biotechnology to Select Industries equity portfolio.

Adding A Position In Biotechnology

Adding new 6% holding in Biotech stocks, replacing holdings from Distillers & Vintners as well as Fertilizers & Ag Chemicals (both groups deactivated).

Weakness In Health Care GS Scores

Health Care was our top-ranked sector from March 2003 to February 2004. Since that time, the sector’s composite score has steadily fallen.

Sector Spotlight: Health Care Watch

We view Health Care as a key theme in 2004. The sector is defensive and sports high growth rates thanks to the large (and growing) demand from elderly Americans.

Sector Spotlight: Health Care Watch

There was a brief pause last month in our Health Care scores, and we were proceeding with caution. This month, our GS Score work regained some of that lost momentum.

Sector Spotlight: Health Care

Conceptually we think that the big drug stocks are poised to rebound, but they have yet to rank Attractive in the Group Selection Scores.

Cutting The Drug Business Five Ways

We’ve carved out subsets from Wall Street’s oversimplified classification of drug stocks.

New Select Industries Group Holding: Biotech Implanted In Portfolio

New Biotech holding increased Health Care commitment in Select Industries to 27%.

Health Care...Biotechnology: New Sector Addition in Portfolio

We are activating the biotech sector in the Paid to Play Portfolio. The SS Score jumped to Attractive this month.