Breadth

Yelling “Fire” In A Crowded Theater?

The latest market down-leg triggered one of our short-term breadth oscillators into super-oversold territory. While “oversold” may sound bullish to most contrarians, when SPX becomes as internally weak on a 10-day basis as it did in early October, there’s usually another shoe to drop.

Breadth Catch-Up!

The market broadened enough in July for the NYSE Daily A/D Line to “confirm” new SPX highs—a statistical positive: When the A/D Line made a concurrent 12-month high during July, the average return for August-December was +6.5% versus -1.1% when breadth didn’t confirm the index.

Neutral (But Leaning Negative)

U.S. stocks have either begun one of the most underwhelming and economically illogical bull markets in history, or have staged an exceptionally long and deceptive bear market rally. Our bet is on the latter.

Market Odds For The Second Half

With the halfway point of 2023 two weeks away, the S&P 500 has broken out to a 12-month high. The index has accomplished that feat 32 times during the month of June—or exactly one-third of all cases measured back to 1928.

Sliced Breadth

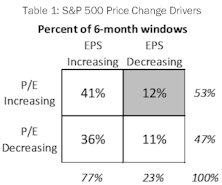

The S&P 500 posted a 7.7% price gain for the six months ended April 30th, although this advance has been a hard-fought battle as gains have resulted from a narrow list of drivers. Style leadership has been concentrated in mega-cap tech names, such that the ten members of the NYSE FANG+® Index have produced 77% of the S&P 500’s YTD gain. Furthermore, gains over recent months have resulted solely from expanding multiples. Narrowness in either thematic leadership or price drivers is concerning because breadth is a useful concept in evaluating the staying power of a market advance. In light of this year’s market action, we are intrigued by the notion of measuring breadth not simply by price moves alone but by examining each of these two important sub-components individually. Does today’s environment, where price gains are driven by valuation increases alone, tell us anything about future market returns?

Research Preview: Market Narrowness In 2023

The S&P 500 posted an encouraging +9.2% YTD, but below the surface that strong return was the result of a limited number of influences. There is narrowness in both thematic and return drivers; the fact that gains have not been broad-based is cause for concern about performance during the remainder of 2023.

“Toro Nuevo” Or Mirage?

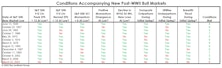

While our breadth measures do not consider this rally to be thrust-worthy, when based on nothing more than performance, it’s difficult to distinguish between the “first up-leg” in a new bull market and a bear-market rally. The vital signs at present appear to be more in-line with the latter (although making that conclusion based on price action, alone, is hardly better than a coin toss).

Nothing Close To A “Thrust”

Many technicians claim that the rallies of late March and late May generated impressive “breadth thrusts.” We’re skeptical: We’ve tested many tools that attempt to capture such a phenomenon, and found that the most reliable thrust signals aren’t ones that show up every couple of months.

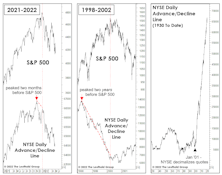

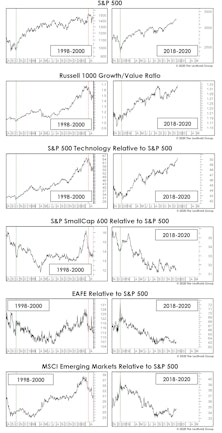

Not Dot-Com

Bulls have been quick to assure us that this market “bears” no resemblance to the dot-com bust. We agree—but probably for very different reasons. Among them are the conventional breadth measures, which provided little warning of this year’s January peak. And, the initial decline off January’s top has been much broader than during the first phase of the dot-com bust.

Limping Into Wildcard Weekend With A Compound Fracture

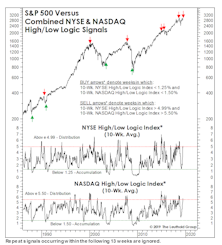

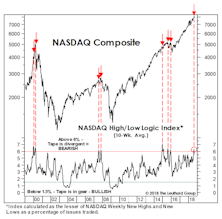

We wrote in the latest Green Book that a breadth indicator that should be more well-known than it is—the High/Low Logic Index (or HLLI)—had moved to “maximum negative” right at the cycle high in the NASDAQ Composite on November 19th. Specifically, the 10-week moving average of this indicator showed a perilous internal condition in which too many NASDAQ stocks were reaching 52-week New Highs and New Lows simultaneously. That’s the very definition of a “fractured” market, and has preceded some important NASDAQ declines. There have also been a couple of premature warnings, as in the summers of 1996 and 2019.

NASDAQ Natterings

In the week ended July 23rd, the NASDAQ accomplished a rare feat by closing at a 52-week high at the same time that more of its members were pegging 52-week New Lows than New Highs. That last occurred at the exact NASDAQ high preceding the GFC collapse; there was also a timely warning ahead of the crash of 1987.

The “Tape” Doesn’t Always “Tell All”

Technicians are collectively bullish because of the absence of any serious internal divergences. But, severe corrections can erupt with little, or no advance warning from a deterioration in breadth and leadership. In fact, the first few years of the last bull market provided two such examples (mid-2010 and mid-2011).

Revenge Of The Nerds?

Last month we detailed two technical shortcomings of the rally off the March 23rd market low. The stock market duly noted our critique and has issued its response.

Can The Rally Recover From Its 0-For-8 Start?

The current rally is either the first upleg of a new bull market, or the second-largest bear market rally in the last 125 years. The lone development that can settle the issue is for the S&P 500 to move above its February 19th closing high of 3,386.15.

A Bounce Without “Oomph”

One would think that one of the most explosive market rallies of all time would trip-off all the traditional “breadth thrust” signals, or maybe even invent a few of its own. Sorry, no luck.

This Bounce Lacks “Oomph”

Through last night’s close, the S&P 500 had gained 25.0% in exactly one month. Impressive, but a bit superficial. Anyone running active equity portfolios recognizes the breadth of this move has been unusually narrow.

Let’s Concentrate For A Moment

In the immortal words of Lloyd Bridges, “Looks like I picked the wrong week to quit drinking.” Let’s put aside this week’s market turmoil and concentrate for a moment on... “concentration.” Market concentration, that is. Close your eyes and think back to those carefree days of mid-February.

Closing The Books On Another “1999”

It’s been a while since we looked at 2019’s stock market parallels to 1999. Sorry about that… we’ve been too busy reliving 1999 on almost a daily basis, and often not in a good way.

“Quant Quake” But No Market Quake

Value, High Beta, and Small Cap stocks all captured a few rays of sunlight for the first time in a long while. It’s too early to tell if last month’s leadership U-turns can be sustained, but major market trends are the most susceptible to reverse during cyclical bear markets.

Breadth: Is It Different This Time?

The granddaddy of all technical indicators—the NYSE Daily Advance/Decline Line—continues to make new highs alongside the S&P 500, suggesting the market should move to even higher (but perhaps narrower) highs well into the fall. As noted a month ago, we increasingly suspect that granddaddy may be telling a lie.

The Market Is On Fire… Unless It’s Ice

Yesterday’s S&P 500 new all-time high triggered a few simple internal studies we’ve used to help shape second-half expectations for the stock market.

Are New Lows The Key To New Highs?

Last year’s market decline was one of the largest to have occurred without a lengthy-preceding period in which breadth narrowed and Small Caps significantly underperformed.

A High-Risk Rally

During the market bounce over the last few weeks, we reminded ourselves and others of the old maxim that “bear market rallies look better than the real thing.” Evidently, the stock market overheard us and took the advice as marching orders.

Odds Of Outperforming?

In September, the percentage of S&P 500 stocks outperforming the S&P 500 index fell to 40.7%, the lowest reading since mid-2012. Breadth has followed a conventional path over the course of this unconventional bull market; in the current phase, the odds of outperformance are steadily diminishing.

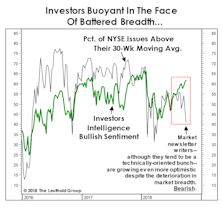

Investor Temperament And The “Tape”

In the first week of October, the share of newsletter bulls topped 61% just as the NYSE percentage slid to 41%. Maybe it’s a seasonal thing… the last time that happened was October 2007.

Technical Difficulties

Traditional breadth measures have yet to show end-of-cycle thinning of the ranks, but some secondary measures suggest that process may be underway.

A Market Breadth Mystery

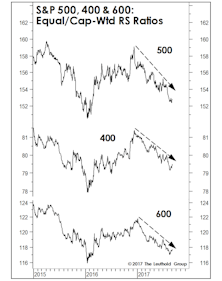

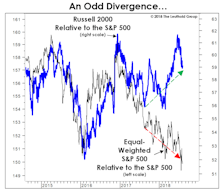

It’s difficult to knock a stock market in which Small Caps and major breadth measures are making frequent new highs, however, there are performance anomalies that suggest liquidity is no longer sufficient to “float all boats.” Recent underperformance of the Equal Weighted S&P 500 is a case in point, at the same time, the current dichotomy in market breadth pales in comparison to the 1999-2000 episode.

The Bulls And Bears Agree!

Yes, bulls and bears now hold their respective positions for the same reason—i.e., the U.S. economy is exceptionally strong. The stock market is accommodating this rare bipartisanship with sufficient reason to support either position.

Is Market Breadth Misleading?

The stock market has narrowed, but not in the way we envisioned—nor in a way that’s consistent with most historical bull market tops. Small Caps and market breadth measures are traditionally the first to wilt when monetary tightening begins to hit the stock market. Instead, they are the leaders.

Breadth Is Great— Except Where It Matters The Most

Last week’s piece challenged the now popular view that new highs for the Russell 2000 are a decisively bullish factor for the stock market in the near term. To our surprise, we found that market returns during periods of well-defined Small Cap leadership are significantly lower than when Smalls are laggards.

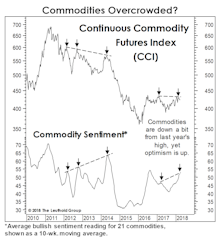

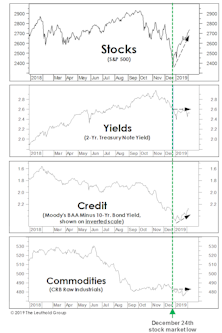

A Troublesome Commodity Pattern...

During each of the last five months, the U.S. economy has shown a broadening array of “late-cycle” characteristics.

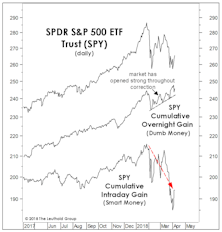

Assessing The Selling

While the January 26th bull market high illustrated none of the hallmarks of a major cyclical top, there are secondary signs that a stealthy distribution process may be underway, such as an overwhelming bias toward opening market strength followed by intraday weakness.

Most Likely Just A Correction

So, what happened to the January Barometer—the old analyst’s maxim that a market gain in January portends a gain for the full year?

Seasonality And Market Breadth

While the FANGs—and, lately, the Dow stocks—are the market’s undisputed leaders, it’s difficult to argue the market has narrowed in a fashion that’s indicative of a “distribution” phase.

Stock Market Observations

We remain bullish on stocks but with very limited visibility into 2018.

Market Breadth Has Yet To “Lie” Down

We shouldn’t bite the hand that feeds us, but it’s easy to lie with charts.

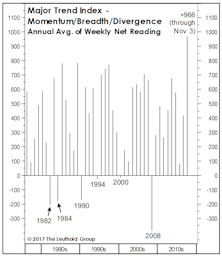

Bonds, Breadth, And Leadership: A Simple Model

Hard-core statisticians might be disappointed to learn that the 140-ish inputs in our Major Trend Index (MTI)aren’t entirely “independent and uncorrelated.”

Stock Market Observations

Second-half results showed the U.S. emerging from the 2015-2016 profit recession, and our early read is that the first quarter should show more of the same.

Stock Market Observations

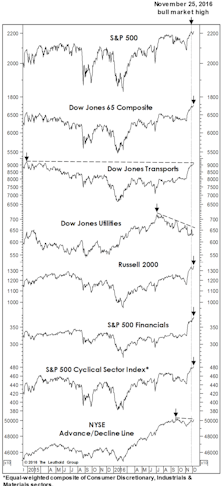

We revisit our “Red Flag Indicator” of prior bull market tops versus today. Usually most of these internal market measures will deteriorate in advance of the final bull market peak. At the latest S&P high, three of the seven leading measures had raised Red Flags, by not confirming, but two of them (DJ Transports and the NYSE A/D Line), are within just ticks of new bull market highs.

Charts: Beware Of Myopia

Despite a two-month stall in the blue chips, the breadth and momentum behind the market’s rally off mid-February lows remain hard to deny.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)