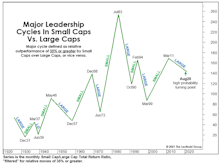

Capitalization Leadership Cycle

The Cycle That Never Was

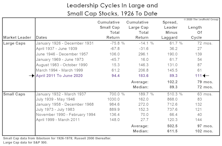

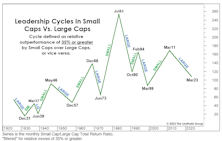

At 144 months, this is now the longest Large-Cap cycle on record, but its dominance will have to prolong to eclipse the second-longest leadership phase (1946-1957), in which Large Caps achieved a 190% performance spread above Small Caps.

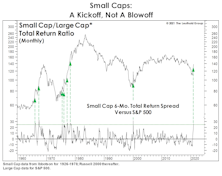

Small Caps: It’s Still Early

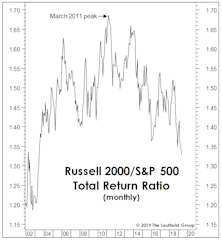

Technical analysts continue to be aghast at the relentlessly “overbought” readings generated by Small Cap stock indexes. However, last month we noted that such extremes had previously presented themselves only at the early or middle phases of a Small Cap leadership cycle—never at the end of such cycles.

When “Overbought” Is Bullish

The recent months’ surge in Small Caps has been historic, and the Russell 2000 continues to register ridiculously “overbought” readings on many technical oscillators. In the short-term, that might be a cause for caution on the overall market. However (and perhaps counter-intuitively), this extreme strength cements our view that a long-term leadership cycle in Small Caps is underway.

Just A “Small” Beginning...

Knee-jerk contrarians are already claiming the stampede in Small Cap stocks is “too consensus” to continue in the near term. We couldn’t disagree more. In fact, we are very confident that a new multi-year Small Cap leadership cycle has kicked off.

The Rotation Should Hardly Be A “Surprise”

Consumer Price Inflation of 1.2% for the twelve months through October remains way below the Fed’s long-time 2% objective, which is nothing new. But a first step in getting inflation to eventually run a little bit “hot” (the Fed’s new objective) is to break the long-term disinflationary psychology among consumers and investors, and that is clearly happening. In fact, based on the excellent “Inflation Surprise” Indexes published monthly by Citi, the U.S. is now the world’s inflationary hotspot!

The “Next Big Thing” May Not Be Big

There’s one trend that’s lasted almost as long as the bull market and economic expansion and it hasn’t definitively come to an end. The current Large Cap Leadership Cycle hit the nine-year mark in April.

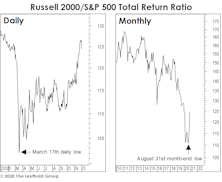

Big Is Still Beautiful

The 10-year-old bull grabs most of the headlines, but its younger sibling has begun to command more respect.

Allocation Implications Of Full Employment

While the economy’s move above its full-employment level carries reliably negative implications for profit margins, the impact on equity returns has varied greatly from cycle to cycle.

Small Cap Premium Finally Shrinks—But Remains Historically Extreme

July’s Russell 2000 -6% rout finally deflated some of the Small Cap valuation premium we’ve been grousing about in recent years.

Running The Math On Mega Caps

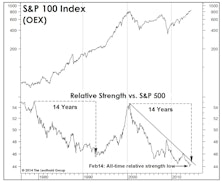

The recent move by the S&P 100 Index (OEX) above its historic March 2000 high prompted us to take a closer look at the turnaround potential of this perennially underperforming Mega Cap index. Remember, a Large Cap leadership cycle has been in force since April 2011—with the trend strengthening the last few months. What are the prospects for the biggest of the Big Caps?

Is It Small Cap Time?

After weighing the pluses and minuses, it still looks like big cap leadership to us...small caps lacking sponsorship and liquidity at this point.

.jpg?fit=fillmax&w=222&bg=FFFFFF)